By Fabian Neiger, Ramon Zehnder, Marcus Alexander Strange Hanson, Miriam Khader, Johanna Franz, and Prof. Kristjan Jespersen

As climate change and the impact thereof intensifies, climate adaptation finance has become increasingly relevant. With the 2020 Green Deal, Europe has shown significant commitment to reaching its sustainability goals. However, achieving the set targets requires substantial funding, which goes beyond public sources. Private sector involvement is essential for the effective implementation of climate adaptation projects, as well as making sure they are completed within the aimed-for period.

Below, we map out the climate finance landscapes of Spain, Portugal, Slovenia, and the Czech Republic, showing the current state of climate adaptation finance in the assessed countries. Next, the roles of governments, banks, funds, and insurance companies are presented together with an analysis of the key investment criteria for these main private-sector persona. Based on this we identify opportunities and recommendations for enhancing private sector engagement.

This blog post is based on a research project supervised by Professor Kristjan Jespersen from Copenhagen Business School (CBS) and Stella Whittaker from the EU Horizon CLIMATEFIT Project. By combining an extensive literature review with interviews with country facilitators of the target countries, and consultations with experts in climate adaptation finance we analysed the roles of key investor personas and revealed their perspectives as well as common investment behaviours.

Financial Landscapes

The climate adaptation landscape in Spain, Portugal, the Czech Republic, and Slovenia is extremely similar, characterized by a reliance on public funding. The funding primarily comes from European Union programs such as the European Social Fund Plus (ESF+) and the European Regional Development Fund (ERDF). In each country, national governments and municipal authorities also contribute to climate adaptation projects, while participation from the private sector remains limited but is gradually emerging

In the analysed countries, the private sector is beginning to include sustainability and ESG (Environmental, Social, Governance) criteria in their financial operations. Yet, the implementation of these practices is moving slowly. For instance, banks like CaixaBank and BBVA in Spain, NovoBanco in Portugal, and select insurance companies in Slovenia and the Czech Republic are starting to offer green financial products to their customers. However, this involvement is not yet fully integrated into investment strategies.

Roles of Key Personas

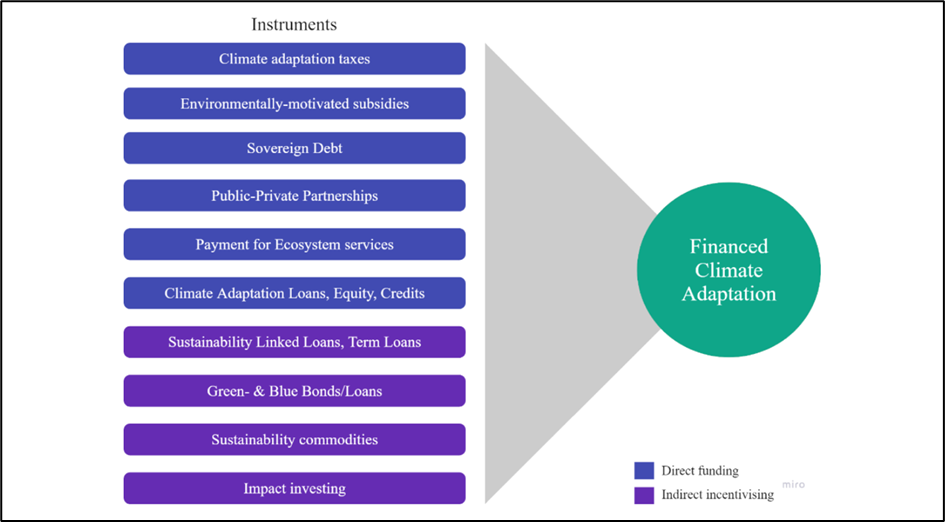

Governments play a crucial role in climate adaptation finance through direct funding and indirect incentives. They use various tools such as climate adaptation taxes, environmental subsidies, sovereign debt, public-private partnerships, and sustainability-linked loans to achieve their climate adaptation goals (see flow chart below). Governments are uniquely positioned to implement control mechanisms and drive large-scale adaptation projects.

Banks are major sources of funding for climate adaptation projects, though they have yet to fully integrate climate risks into their financial risk management. Recent extreme weather events (e.g., floods in Slovenia) have increased awareness of these risks, prompting some banks to adopt initiatives and standards for responsible investments. However, the overall adoption remains slow.

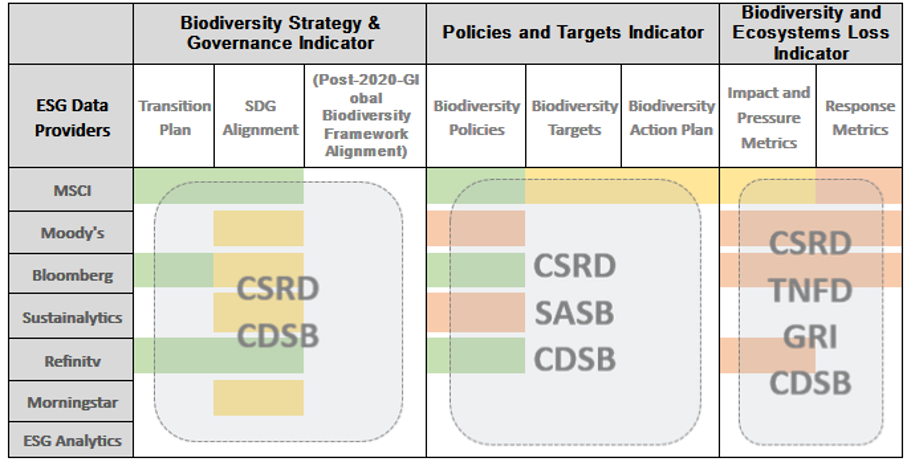

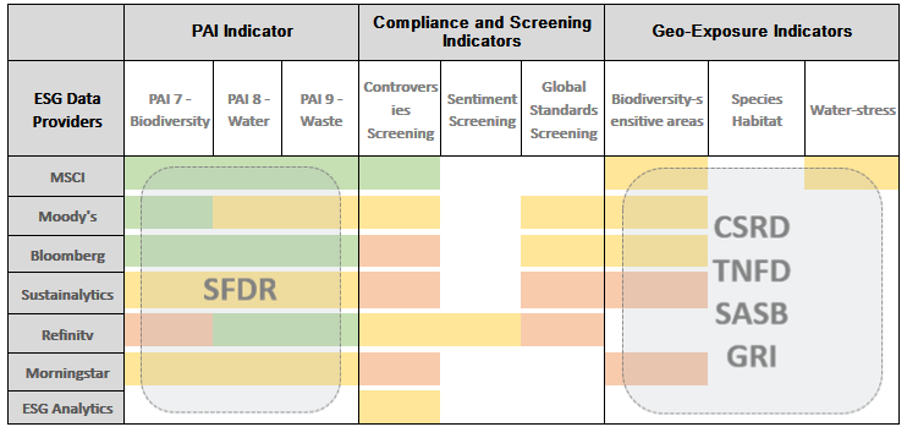

Insurance companies face significant risks from climate change and are beginning to incorporate climate adaptation into their business strategies. They recognize the need to protect natural ecosystems and align financial flows with the Global Biodiversity Framework. Insurers are mobilizing financial resources for sustainability projects and promoting greater transparency in environmental impact disclosures.

Investment funds, particularly pension funds, show a growing awareness of the need to invest in natural capital. However, challenges such as lack of proven track records, insufficient data, and limited understanding of sustainable finance hinder greater investments in climate adaptation projects. Funds typically prioritize financial returns but are open to long-term investments under the right conditions.

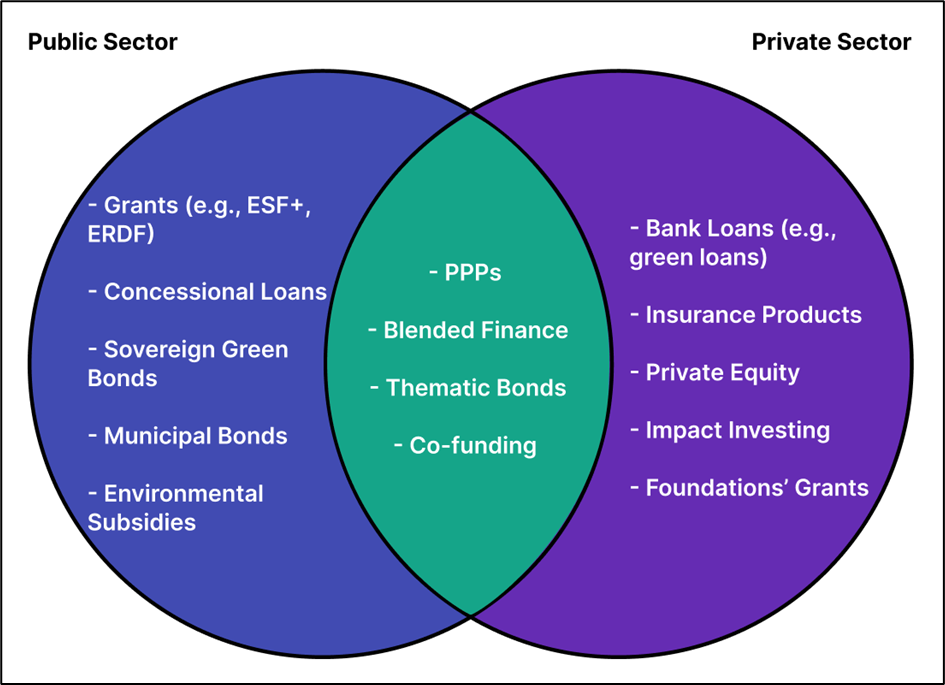

Increased private sector involvement in climate adaptation finance is urgently needed in the face of intensifying climate change impact. Currently, Spain, Portugal, Slovenia, and the Czech Republic are severely lacking climate adaptation projects. Key barriers include risk perception by the investors, lack of clear business models of the projects, and insufficient data on investment outcomes, which in turn deter private-sector involvement across the board. The Venn diagram below illustrates the various financial instruments used by both sectors, as well as those that require collaboration.

Recommendations

To address challenges and enhance private sector engagement, we recommend the following actions for the EU Horizon CLIMATEFIT Project:

- Establishing a central knowledge platform: Organize and curate up-to-date information on climate impacts, adaptation strategies, and case studies to enhance industry awareness.

- Assisting governments in leveraging existing tools: Advocate for regulatory changes that incentivize private sector investments and work closely with governments to utilize available tools effectively.

- Develop standardized metrics: Create metrics for measuring adaptation project impacts, including climate resilience, economic returns, and social equity, to help investors build robust business cases.

- Foster stakeholder collaboration: Engage stakeholders through networking events, best practice sharing, and collaborative projects to enhance private sector participation in climate adaptation finance.

Both public and private sectors play a critical role in driving climate adaptation finance. By enhancing knowledge sharing, leveraging existing tools, and fostering collaboration, significant progress can be made in mobilizing the necessary investments for a resilient and sustainable future. The EU Horizon CLIMATEFIT project is well-positioned to lead these efforts, bridging the gap between public authorities and private investors to achieve meaningful climate adaptation outcomes.

About the Authors:

Fabian Neiger is a recent graduate of the CEMS MiM program from Copenhagen Business School and Esade Business and Law School, as well as a graduate of the Msc Innovation and Entrepreneurship from Esade Business and Law School. His interest in sustainability and finding innovative solutions for a fairer world drives his passion for ESG research and the implementation thereof.

Ramon Zehnder is a graduate candidate of the MA in Management, Organizational Studies and Culture from the University of St. Gallen. He is especially interested in the complex interplay between private and public organizations in Sustainability and currently researching on CSR in professional sports organizations.

Marcus Alexander Strange Hansen is a graduate candidate at the Technical University of Denmark studying a Msc in Industrial Engineering and Management. He is interested in renewable energies and providing cities and households with green electricity, working part-time at TotalEnergies as a Business Developer focussing on renewables.

Miriam Khader is graduate candidate at the Technical University of Denmark studying a Msc in Transport and Logistics. She is driven by sustainability and civil engineering projects, looking to help shape the world to be liveable for all.

Johanna Franz is graduate candidate at the Technical University of Denmark studying a Msc in Industrial Engineering and Management. She is fascinated in finding solutions to make production more sustainable by not only optimising the processes, but also looking at the individual steps and discovering, where to improve on material choice and energy consumption.

Prof. Kristjan Jespersen is an Associate Professor in Sustainable Innovation and Entrepreneurship at the Copenhagen Business School (CBS). Kristjan is an Associate Professor at the Copenhagen Business School (CBS). As a primary area of focus, he studies the growing development and management of Ecosystem Services in developing countries. Within the field, Kristjan focuses his attention on the institutional legitimacy of such initiatives and the overall compensation tools used to ensure compliance. He has a background in International Relations and Economics.