By Alexandre Dahman-Leloup, Marc Philippe Farahmand, Julian Matlok Johansen and Prof. Kristjan Jespersen

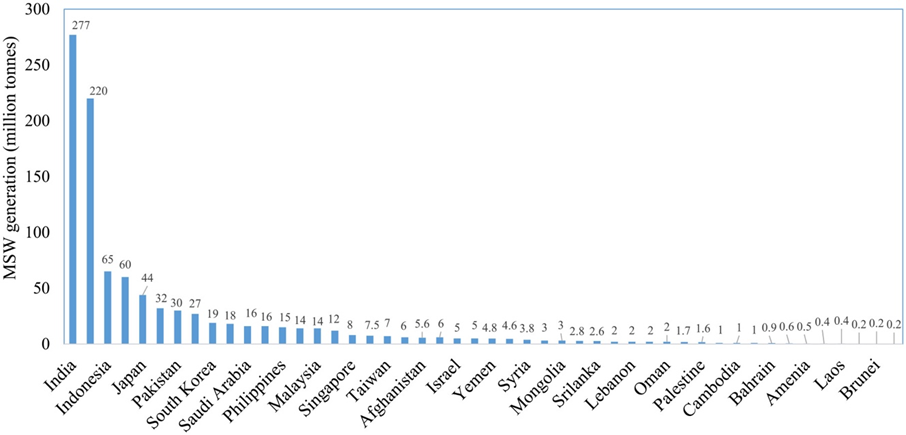

Indonesia, one of the most populous countries in Southeast Asia and the world’s third-highest CO2 polluter, houses Gojek-Tokopedia (GoTo). The Indonesian company set itself the goal to be a 24/7 solution provider for consumers with its pioneering tech platforms offering online shopping, food delivery, payment methods, etc. Additionally, the organization is driven by a mission to create a better world for future generations through serious and ambitious ESG goals. Being a facilitator of a B2B2B / B2B2C platform1 more than 99% of their waste comes from their external partners. The major issue is packaging, especially food take-away packaging. Indonesia’s municipal solid waste (MSW) collection is hampered by insufficient policy, enforcement, funding, infrastructure, and stakeholder engagement, issues exacerbated by a growing middle class. The research is a case study solely focused on interpreting the secondary research of the company GoTo. The following findings are based on academic and grey secondary literature focused on the Indonesian market and comparable markets in the APAC region such as Malaysia. The research aimed to present recommendations for GoTo on a short- and long-term to reduce their waste.

The research question is as follows: How can GoTo reduce Scope 3 waste in Indonesia through strategic marketing and operational initiatives considering the limitation of having no decision-making power for the partners?

Looking deeper into the MSW in Indonesia most of it comes from residential homes and is mainly bio-degradable waste, which should be seen as a resource rather than just waste. It can be separated, composted, and reused. The second largest portion is (single-use) plastic, which ends up being turned into microplastics. This is a growing issue, which will not cease to grow until plastic waste is tackled properly. So why is GoTo tackling this issue? Not simply because it is the right thing to do, but because the double-materiality cost cannot be overlooked anymore, and when sustainability goals align with business goals, long-term value can be created.

GoTo’s contribution to lowering the CO2 emissions and waste of Indonesia is by mainly tackling their current packaging solutions for food delivery. Their external waste is driven by plastic waste (15,9%) right after food waste (25%). One major source of plastic waste is the packaging of food; for that, therefore, finding alternative packaging options is crucial. The main options available on the market are listed and explained in the following table.

| Material | Pros | Cons | Costs (relative to plastic) | Products |

| Paper and Cardboard | Biodegradable, recyclable, renewable | Susceptible to moisture and damage | Generally expensive, but cost varies with coating and treatment | Boxes, Cartons, Bags, Wrappers, Cups |

| Glass | Recyclable, Inert, Preserves, Content quality | Heavy, Breakable, Higher transportation costs | Significantly more expensive | Bottles, Jars |

| Metal (e.g., aluminium, tin) | Recyclable, Durable | Expensive, Energy-intensive production | More expensive, but cost can vary based on recycling efficiency | Cans, Tins, Foils |

| Natural Fibres (bamboo, cotton) | Sustainable, Compostable, Renewable | Limited availability, Higher cost | More expensive, depends on sourcing and processing methods | Containers, Cushioning, Wraps |

| Biopolymers (PLA, PHA) | Compostable, Reduces plastic waste | Higher cost, Limited shelf life | More expensive | Packaging films, Containers, Bags |

In Europe we can see that alternative packaging is widely used, mainly biodegradable plastics, recycled paper, and glass, pushed by the European Union regulations. In North America, plastic is still mainly used for convenience and cost-effectiveness. However, a growing trend towards sustainable options, such as recyclable paper and biodegradable paper has arisen recently. In terms of pure sustainability, in a market like Indonesia, biodegradable plastics and natural fibres such as bamboo and coconut husk are the most sustainable options. They are compostable, reduce landfill waste, and are derived from renewable resources, minimizing long-term environmental impact. Nevertheless, they are quite costly and could pose durability issues. When considering cost and sustainability, recyclable paper and cardboard are the perfect alternative packaging, as they are cost-effective, and sourced from renewable resources. They can be used on a large scale without substantial long-term sustainability damage with complementing process recycling processes. Additionally, these materials are biodegradable as well as a low carbon footprint.

Nonetheless, considering the business model of GoTo being a platform, the tech company needs a plan to motivate external partners (local restaurants) to implement the more costly sustainable packaging alternatives. Theoretical research suggests implementing a pull strategy by capitalizing nudging tools. A pull strategy creates market demand directly at the consumer level which forces the business to change their product or service offers to meet the new demand. In the GoTo case, it would mean creating consumer demand for a sustainable and conscious lifestyle through educational marketing campaigns. These campaigns can help consumers understand the benefits of sustainable packaging and drive demand for it.

Complementing the pull strategy, nudging tools can subtly influence consumer choices. Nudging, a concept from behavioral economics, influences consumers unconsciously in their purchasing behaviour. In practice, GoTo could implement nudging by creating default options when ordering such as smaller sizes, sustainable packaging materials, or removing cutlery/ napkins from orders.

Overall, the research has identified three main recommendations that GoTo can implement in the short-, medium-, and long-term to push their ecosystem to use sustainable packaging alternatives like recyclable paper and cardboard:

- Create consumer demand for sustainable options via an educational marketing campaign which indirectly creates market change.

- Implement sustainable default options for the consumer when ordering meals

- Implement a Green Badge in the app which informs consumers about restaurants that choose sustainable options such as recyclable paper and cardboard packaging alternatives. The variables that give a restaurant a Green Badge can be modified by GoTo; yet it should include the packaging alternative, local purchasing, and CO2 and waste reporting processes.

Crucial when implementing all recommendations is to transparently communicate it with their ecosystem and the government due to the underlying problem of a lack of MSW management infrastructure in Indonesia.

About the Authors:

Alexandre Dahman-Leloup is currently enrolled in the Master in Management at TBS education, and the exchange program at Copenhagen Business School. He is interested in CSR, focusing on how companies can minimize their carbon emissions.

Marc Philippe Farahmand is a recent graduate of the CEMS Master in International Management from the Michael Smurfit Graduate School of Business in Dublin and the Copenhagen Business School. He is interested in CSR and sustainability in the business context focusing on CO2 reporting accuracy and transparency.

Julian Matlok Johansen is currently enrolled at the Technical University of Denmark, studying an MSc. in Technology Entrepreneurship. He also holds a Graduate Diploma in Business Admin. and Innovation Management from CBS. His interest in sustainability stems primarily from the area of Business Design for Sustainability, how startups can create a better world tomorrow.

Prof. Kristjan Jespersen is an Associate Professor in Sustainable Innovation and Entrepreneurship at the Copenhagen Business School (CBS). Kristjan is an Associate Professor at the Copenhagen Business School (CBS). As a primary area of focus, he studies the growing development and management of Ecosystem Services in developing countries. Within the field, Kristjan focuses his attention on the institutional legitimacy of such initiatives and the overall compensation tools used to ensure compliance. He has a background in International Relations and Economics.

- B2B2B or B2B2C is a concept in which three parties are involved; usually, one party is the middleman and adds value with its network. This is the same case for GoTo whioch connects various parties (businesses or customers) with their platform. ↩︎

- Kaza, S., Yao, L., Bhada-Tata, P., & Van Woerden, F. (2018). Waste and society. In The World Bank eBooks (pp. 115–140). https://doi.org/10.1596/978-1-4648-1329-0_ch6 ↩︎

- Food Standards Agency. (2024). Alternatives to single-use plastics: Results. Food Standards Agency. Retrieved May 29, 2024, from https://www.food.gov.uk/research/alternatives-to-single-use-plastics-results ↩︎