By Kristjan Jespersen and Kedar Uttam

Leading the fight against deforestation

Funded by European Commission’s Erasmus+ Programme

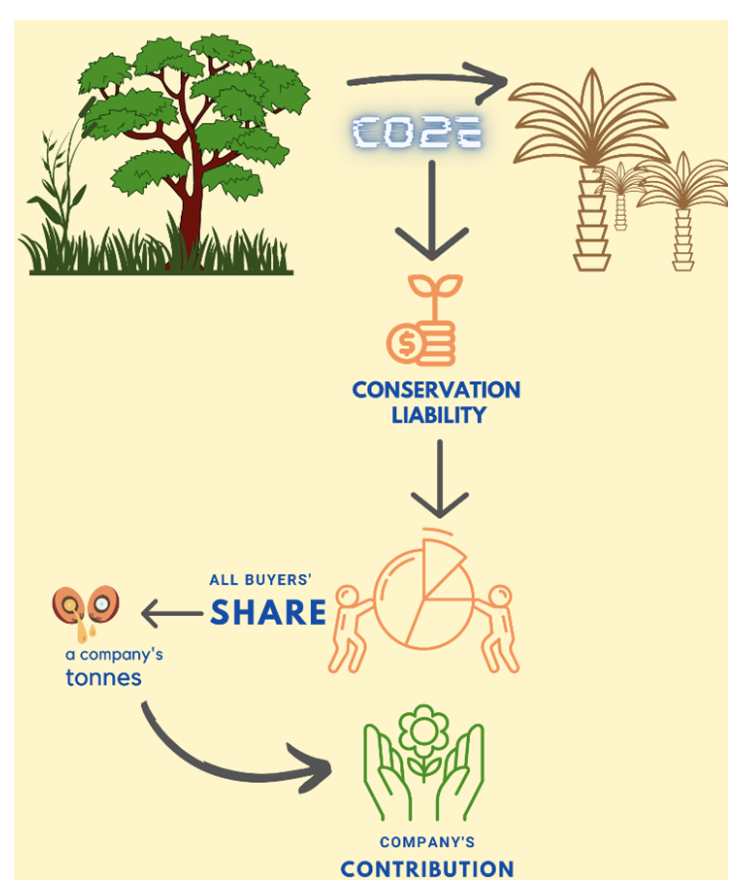

A concerning trend has emerged as various forests worldwide face severe deforestation to make way for the expansion of agricultural activities intended for the production of specific commodities like palm oil, soy, beef, and coffee. These commodities, aptly termed forest risk commodities (FRCs), bear this nomenclature due to the inherent risk they pose to the very ecosystems and climate upon which we depend. They pose a risk to the forests and the climate. Notably, the European Union (EU) stands as one of the primary consumers of FRCs, with its demand intricately linked to a staggering 16% of the global deforestation – an area almost the size of Luxemburg. Therefore, the EU needs to ensure that the FRCs it imports are not causing harm to the environment and the people who depend on it. This is not an easy task, because deforestation is often considered to be a forestry problem without acknowledging its connection to the way we grow food, trade goods, and consume products, all along the supply chains that bring them to us. Deforestation is rather a complex problem that involves many different factors, such as agriculture, trade, consumption, and governance. This complexity should also be reflected in the education and training programmes, offered by universities and vocational schools. Thus, students and professionals must be equipped with the knowledge and skills necessary to traverse these diverse domains, bridging the chasms between sectors and fundamental disciplines, including compliance, technology, and corporate social responsibility. These proficiencies are pivotal in paving the way for the creation of deforestation-free supply chains (DFSCs). Most collective commitments by both private and public entities to achieve DFSC have proven ineffective in reversing the trend. Consequently, the European Commission (EC) has recently given its approval to the EU Deforestation Regulation (EUDR), which aims to prohibit the import of FRCs) originating from land deforested after 2020. Given these circumstances, there is a clear need for innovative approaches in the realms of education, training, and capacity development aimed at mitigating deforestation risks within the supply chains of FRCs in the EU.

The pressing need to address deforestation is at the forefront of our collective consciousness, and it is this very need that drives the mission of EMMA4EU. This visionary project seeks to combat deforestation by creating an EU alliance of universities, vocational schools, businesses, public organisations and NGOs, to develop innovative training solutions for a new profession: the deforestation-free supply chain (DFSC) manager. Armed with a specialized skillset of comprehensive knowledge, the DFSC manager will possess the skillset and knowledge to ensure that the FRCs imported by the EU are produced in a sustainable way, without causing deforestation or violating human rights. The DFSC manager will also be able to use digital and green technologies to improve the efficiency and transparency of the supply chains, and to comply with the EUDR. Through the creation of this innovative profession, EMMA4EU will catalyze the transition toward a greener and more circular economy, facilitating the EU’s journey to meet its climate targets and attain climate neutrality by the pivotal year 2050.

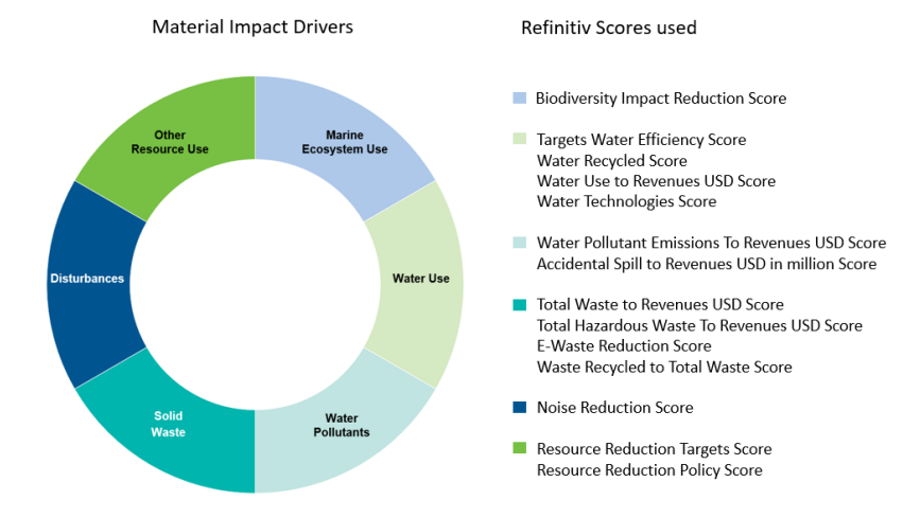

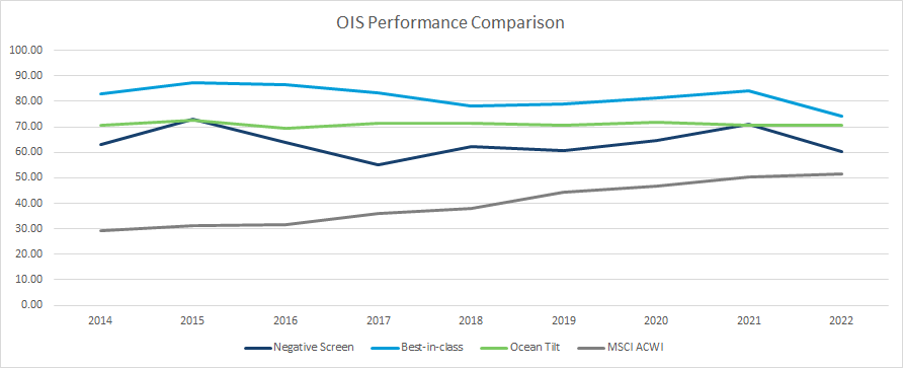

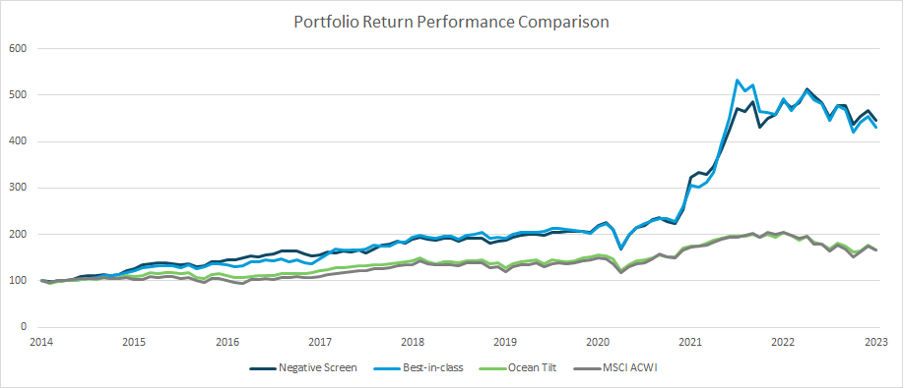

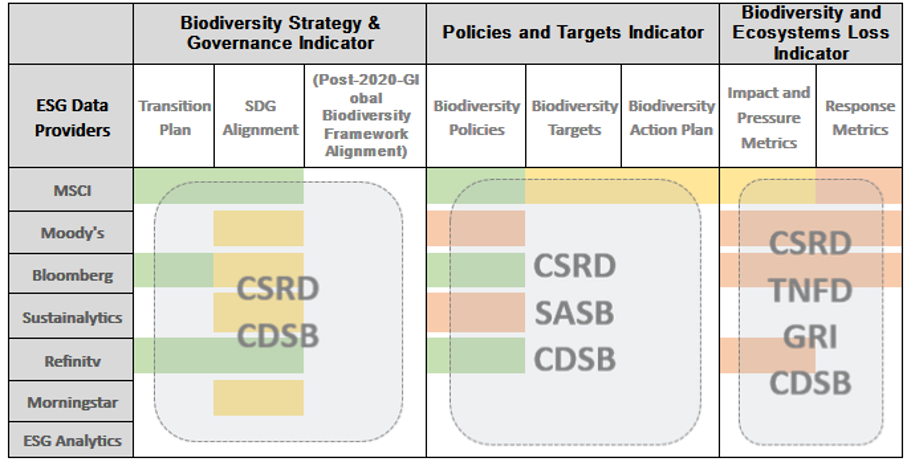

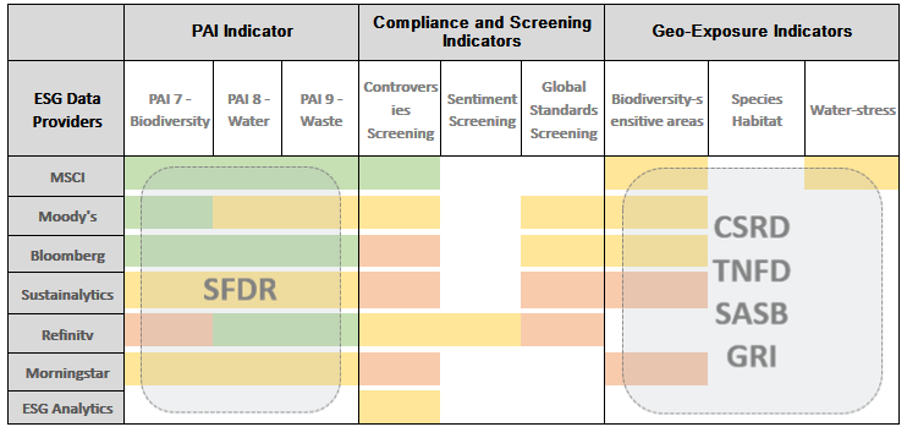

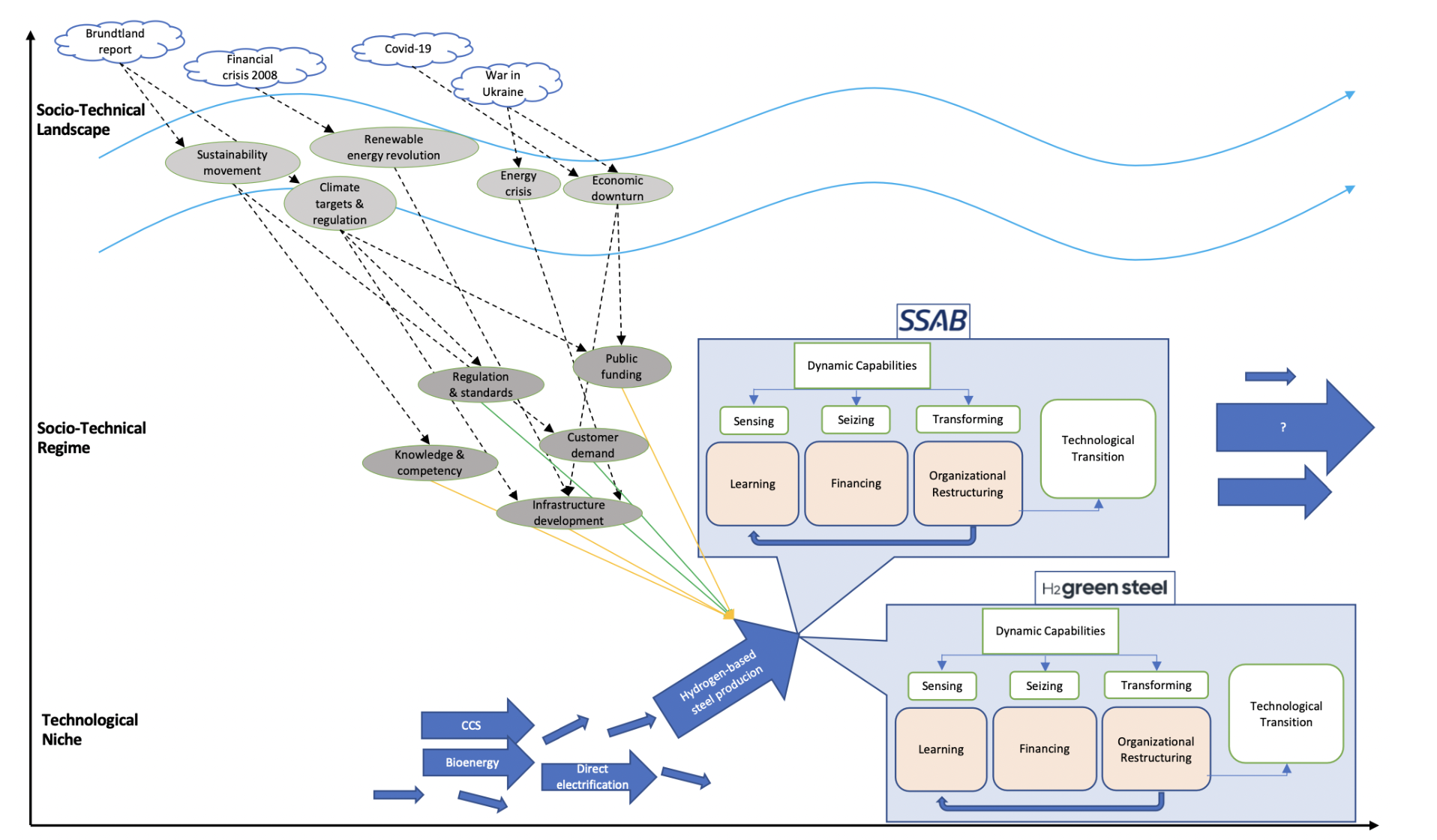

The Copenhagen Business School (CBS) actively engages as a part of the EMMA4EU consortium, which consists of 11 partners from different countries and sectors. Our core role within this visionary initiative encompasses the assessment of training and implementation activities, as well as the critical management of process-oriented activities, including project oversight, dissemination, and communication. By diligently gathering and scrutinizing data from our fellow partners, we remain poised to offer crucial feedback and interventions to ensure the project adheres to its work plan and schedule. In tandem with our consortium counterparts, we contribute to the development of a comprehensive research and assessment framework, involving an exhaustive review of the prevailing scientific literature and knowledge related to impact assessment and Environmental, Social, and Governance (ESG) dimensions, encompassing metrics and biodiversity-related financial risks within the realm of Deforestation-Free Supply Chains (DFSCs). Additionally, we play an integral role in enhancing the training materials by constructing teaching cases centered on the intricate issue of deforestation. In a collaborative effort with the University of Freiburg, we are committed to crafting an EU innovation report that delves into the myriad factors influencing the efficacy, or lack thereof, in DFSC regulation, including the exploration of business models and associated tools. Through these multifaceted endeavors, CBS and its consortium partners are firmly committed to advancing sustainable and ecologically sound practices, aligning with the broader mission of ecological economics.

Photo Caption: First in-person EMMA4EU partners’ meeting at Villa Parlo Bolasco in Castelfranco Veneto, Italy held between 2 and 3rd November 2023.

Kedar Uttam is a postdoc at CBS, Kedar analyzes the integration of environmental, social, and governance (ESG) factors in ocean financing and the role of institutional work in marine conservation finance. Additionally, Kedar is actively engaged in developing business cases for the ocean economy and ESG curricula. He has a background in Environmental Engineering and PhD with specialization in Environmental Management and Assessment.

Prof. Kristjan Jespersen is an Associate Professor in Sustainable Innovation and Entrepreneurship at the Copenhagen Business School (CBS). Kristjan is an Associate Professor at the Copenhagen Business School (CBS). As a primary area of focus, he studies the growing development and management of Ecosystem Services in developing countries. Within the field, Kristjan focuses his attention on the institutional legitimacy of such initiatives and the overall compensation tools used to ensure compliance. He has a background in International Relations and Economics.