By Prof. Kristjan Jespersen, Oliver Daniel Koch and Ida Marie Arends.

In today’s rapidly evolving landscape, financial institutions are increasingly pressured to prioritize Environmental, Social, and Governance (ESG) considerations. But what does strategic ESG alignment really entail, and how does it shape sustainability commitments in the Danish banking sector?

Denmark, renowned for its proactive stance on sustainability, provides a rich context to explore these dynamics. At the heart of this landscape is Nykredit, whose status as a Systemically Important Financial Institution (SIFI) and its unique association-owned structure position it uniquely to support Denmark’s ambitious green transition.

Balancing Stakeholder Expectations

Banks today must navigate complex stakeholder environments, balancing long-term sustainability with profitability. Through our study of Nykredit, we applied both Institutional Theory and Stakeholder Theory, shedding light on how banks balance societal and institutional pressures while strategically managing diverse stakeholders.

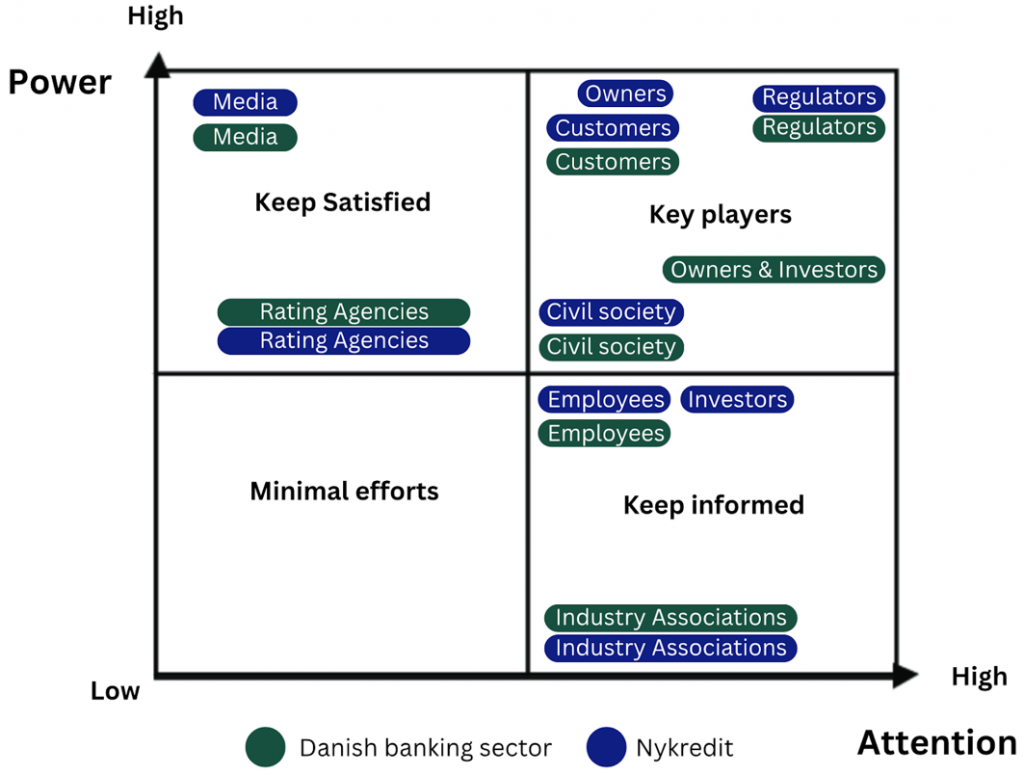

Our research found that stakeholders within the Danish banking industry hold diverse expectations regarding ESG actions. For Nykredit, stakeholders such as regulators, owners, civil society, and customers emerge as particularly influential, due to the bank’s ownership structure and customer-centric business model.

Illustration 1: Power/Attention Matrix of Influence from Stakeholders on Nykredit and Peers

ESG Integration and Institutional Pressures

Nykredit, along with its peers, experiences significant regulatory pressures, reflecting strong coercive isomorphism. Regulations have increasingly formalized corporate governance processes, compelling banks to adopt consistent ESG standards. Alongside regulatory pressures, mimetic pressures – where institutions follow leading practices – have pushed Danish banks toward convergence in sustainability commitments.

Yet, Nykredit stands apart by proactively integrating ESG responsibilities at the highest decision-making levels and through differentiated sustainability commitments. Rather than widespread ESG campaigns, Nykredit emphasizes targeted communication with key stakeholder groups, enhancing its responsiveness and reinforcing its leadership position among peers.

Benchmarking ESG Leadership

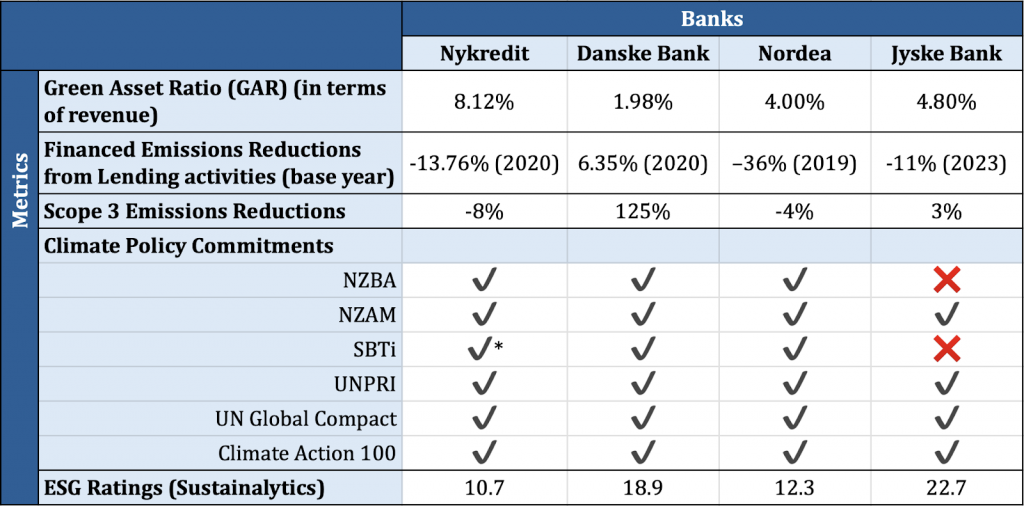

A comparative analysis against Denmark’s largest banks shows Nykredit’s proactive and strategic leadership. Nykredit’s strategic alignment with stakeholder expectations has not only concretized its ESG efforts but has also elevated the ambition and depth of these initiatives, positioning the bank strongly in addressing climate-related risks and enhancing overall resilience and reputation.

Our findings indicate that conflicting stakeholder expectations are not fundamentally opposed but rather differ in terms of urgency, ambition, and pace. This nuanced understanding offers valuable insights for financial institutions aiming to align their strategies effectively with stakeholder expectations.

Illustration 2: Benchmarking of Nykredit, Danske Bank, Nordea, and Jyske Bank

*SBTi validated.

Practical and Theoretical Implications

For banks and financial institutions, our study highlights the importance of viewing competitors as ESG stakeholders whose strategies significantly influence sector-wide standards. It underscores how stakeholder-oriented ownership structures can foster ESG leadership, providing banks with practical insights for strategic planning and stakeholder engagement.

On the theoretical front, the study challenges traditional assumptions in Institutional Theory about uniformity in ESG practices. It demonstrates how banks strategically leverage isomorphic pressures to enhance their sustainability profiles and competitive advantage.

Conclusion: Strategic ESG as a Competitive Advantage

Ultimately, our research underscores that aligning ESG strategies with stakeholder expectations transcends mere compliance or reputation management. Instead, it becomes a strategic enabler driving deeper sustainability commitments, competitive differentiation, and institutional leadership. Nykredit’s experience illustrates clearly how proactive engagement and alignment with stakeholders can fundamentally transform a bank’s ESG strategy, setting a benchmark for sustainable finance across the sector.

About the Authors

Prof. Kristjan Jespersen is an Associate Professor in Sustainable Innovation and Entrepreneurship at the Copenhagen Business School (CBS). Kristjan is an Associate Professor at the Copenhagen Business School (CBS). As a primary area of focus, he studies the growing development and management of Ecosystem Services in developing countries. Within the field, Kristjan focuses his attention on the institutional legitimacy of such initiatives and the overall compensation tools used to ensure compliance. He has a background in International Relations and Economics.

Ida Marie Arends holds a MSc in General Management and Analytics with a minor in ESG, Metrics, Reporting, and Sustainable Investments from Copenhagen Business School (CBS). Ida works in Application Portfolio Management in e-Trading at Nordea Markets, where responsibilities include assessing and managing risks, application governance, and compliance of trading and sales applications.

Oliver Daniel Koch holds a MSc in General Management and Analytics with a minor in ESG, Metrics, Reporting, and Sustainable Investments from Copenhagen Business School (CBS). Oliver works as an analyst in Institutions in Nykredit Markets, where responsibilities include overseeing Nykredit’s correspondence network in Denmark and internationally and relational work with institutional clients, mainly banks.