By Prof. Kristjan Jespersen, Cecilie Duch and Nathalie Fichte

In an era marked by accelerating ecological degradation and increasing demand for sustainable economic models, the field of sustainable finance is experiencing a paradigm shift. While CO2 emissions have long dominated environmental metrics in investment decisions, this focus captures only a small part of the sustainability agenda. While important, this narrow focus captures only a fraction of the sustainability agenda. Integrating circular economy (CE) principles offers a broader and more regenerative framework, complementing carbon metrics with deeper insights into material flows, resource efficiency, and long-term system resilience.

The inclusion of circularity into portfolio design

The global economy remains largely entrenched in a linear ‘take-make-waste’ paradigm, wherein resource extraction and waste generation proceed with minimal regard for ecological thresholds. This cradle-to-grave model has propelled humanity toward multiple breached planetary boundaries (Rockström et al., 2023). The ‘Limits to Growth’ report (Club of Rome, 1972) warned already over fifty years ago of the environmental consequences of indefinite economic expansion. Today, its predictions are no longer hypothetical.

In response, the circular economy proposes a fundamental shift in economic logic—from throughput maximization to regenerative value creation. Circularity emphasizes design for durability, reuse, repairability, and closed-loop systems, aiming to decouple growth from environmental harm. Embedding these principles into investment logic may reshape how capital allocation drives systemic change.

Development of the Circular Investment Tool (CIT)

To effectively integrate circularity metrics into portfolio design, a framework for investment screening in the following called CIT was developed. This framework blends automated data analysis with manual review, enabling a more complete and nuanced assessment based on publicly available information.

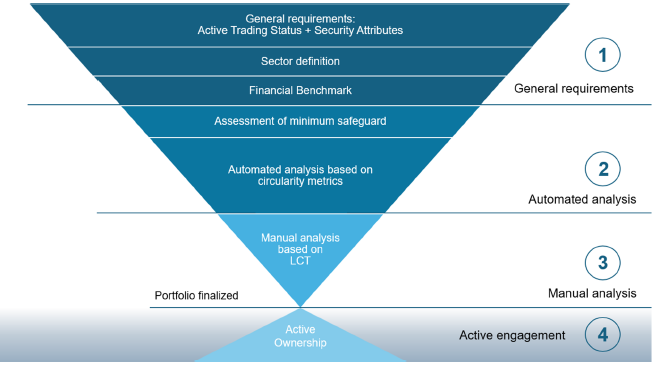

The CIT is designed to integrate seamlessly into investment workflows and includes four key phases:

- General Requirements: Includes sector definitions, financial benchmarks, and minimum ESG thresholds.

- Automated Analysis: Uses publicly available data to assess indicators such as material circularity, product lifespan, and design-for-disassembly.

- Manual Review: Addresses gaps in automated data through qualitative evaluation of transition narratives and disclosures.

- Active Ownership: Encourages investor engagement with portfolio companies to foster long-term improvements in circularity performance.

This integrated approach bridges the gap between data-driven screening and investor stewardship, enhancing both rigor and strategic influence.

Main Findings

The findings present both challenges and opportunities for integrating circularity into sustainable finance:

- Lack of Standardization

A recurring theme was a conceptual ambiguity around circularity, as different practitioners interpreted it in varying ways. There is currently no standardized or universally accepted approach to assessing circularity in investments, which makes its scalability more difficult.

- Proxy Reliance

GHG emissions remain the default proxy for sustainability, overshadowing the complexities of assessing and defining nature and how it is affected by human-led business activities.

- Challenges around data quality and availability

Other prominent challenges were the quality and availability of sustainability and specifically circularity data provided by companies. This was highlighted as an issue limiting integration into portfolio design.

- Proof of Concept – CIT in Practice

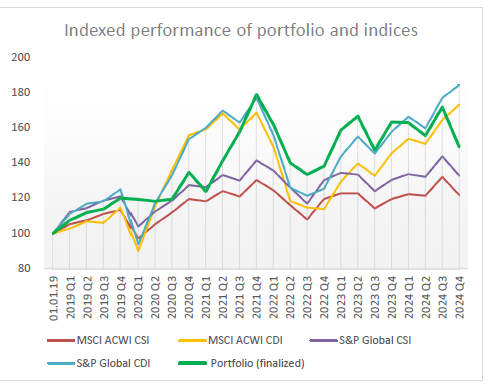

Applying the CIT, we constructed a portfolio of 39 consumer goods companies and benchmarked it against sector-specific indices. The circular portfolio achieved comparable financial performance relative to traditional benchmarks but demonstrated greater resilience during periods of market volatility. This suggests that circularity metrics may bolster risk-adjusted returns and improve foresight in capital allocation.

- Alternatives of the CIT

The discussion of the research elaborates on potential adaptations of the CIT, including the expansion of the manual analysis in regard to its feasibility and added value, the third-party verification of data and its impact on reliability, transparency, and data quality and availability, and the aspect of active engagement

Implications and Future Research

The conducted research explores the reasons behind the absence of a standardized understanding of circularity within the investment landscape, suggesting that this may be partly due to the concept’s relative immaturity. It also highlights the growing relevance and potential influence of circularity in a world marked by geopolitical uncertainty and complex challenges. In addition, the research examines the composition of the designed portfolio, which leans more towards companies demonstrating transitional circular potential rather than incorporating companies with fully circular business models. This underscores the significance of corporate initiatives and forward-looking commitments in advancing circularity.

While the study focused on the consumer goods sector, the CIT was designed with cross-sector applicability in mind. Sectoral expansion should be guided by materiality considerations. Promising applications include construction, industrial manufacturing, and agriculture, where resource intensity and environmental impact are significant.

Integrating circularity into investment decision-making does not compromise financial outcomes. On the contrary, it offers a pathway to enhanced risk mitigation, portfolio resilience, and alignment with long-term sustainability goals. As data quality improves and circular economy principles become institutionalized, tools like the CIT will be essential in shaping the next generation of sustainable investing.

About the Authors

Prof. Kristjan Jespersen is an Associate Professor in Sustainable Innovation and Entrepreneurship at the Copenhagen Business School (CBS). Kristjan is an Associate Professor at the Copenhagen Business School (CBS). As a primary area of focus, he studies the growing development and management of Ecosystem Services in developing countries. Within the field, Kristjan focuses his attention on the institutional legitimacy of such initiatives and the overall compensation tools used to ensure compliance. He has a background in International Relations and Economics.

Cecilie Duch has a HD in business administration and accounting, alongside a Cand.merc in strategy, organization and leadership topped with a minor in ESG from Copenhagen business school (CBS). She has a lead role as a sustainability auditor and consultant. She consults on topics such as ESG, VSME and CSRD reporting, internal sustainability controlling environments and audits of annual sustainability reports. Academically she focuses on sustainability in the business sphere spanning reporting, integration, and responsible investments.

Nathalie Fichte recently completed a MSc in Strategy, Organization, and Leadership with a Minor in Environment, Social, and Governance (ESG) at Copenhagen Business School (CBS). She was working in sustainability consulting and assurance and has prior experience in the area of international development cooperation. This August, she will be continuing working within the field of ESG through joining the department of Management, Society, and Communication at the center for sustainability at CBS as a research assistant. Her academic interest spans from circular economy, ESG reporting, to sustainable finance topics.