By Prof. Kristjan Jespersen, Walter Bachmann, and Naomi Villaruel.

In the evolving landscape of corporate governance, the role of Environmental, Social, and Governance (ESG) considerations has never been more critical. With global standards such as the IFRS S1, IFRS S2, and the European Sustainability Reporting Standards pushing companies to improve transparency and accountability, corporate boards in Norway are facing a pivotal moment. The sustainability expertise gap across Norwegian boards has emerged as a significant challenge, creating pressure for companies to elevate their governance structures to meet these evolving demands. The urgency is amplified by the forthcoming Corporate Sustainability Due Diligence (CSDDD) directive, which mandates clearer evaluations of sustainability efforts at the board level. This blog explores the burning platform of ESG expertise shortages in Norway and presents key findings from a recent assessment.

The pressing issue at hand is that most Norwegian boards are ill-prepared to navigate the complexities of modern sustainability demands. According to a recent analysis, 61% of Norwegian boards only meet minimal ESG standards, with none fully aligning their competencies with the sustainability challenges they face. This lack of preparedness is not only a problem of perception but also one of regulatory compliance, as boards are now required to incorporate sustainability risks into their financial and strategic oversight. The lack of professional experience in sustainable business practices—65% of boards report no relevant expertise—is a critical vulnerability. With global frameworks mandating deeper integration of sustainability, Norwegian companies risk falling behind without significant improvements in boardroom competency.

A standout finding from the assessment is the comparative underperformance of Norwegian boards, particularly when viewed against international benchmarks. Norwegian boards achieved a competency score of just 12%, falling below the global average of 16.4%. While marginally outperforming their Scandinavian peers in Sweden and Denmark, the difference is minimal, signaling a broader regional issue. Despite this, a small subset of Norwegian companies, such as Wilh. Wilhelmsen, stand out. Wilhelmsen’s board achieved an impressive 34% competency score, showcasing how diverse expertise can lead to more effective governance. The company’s performance highlights the critical role that board diversity and experience play in navigating complex sustainability challenges.

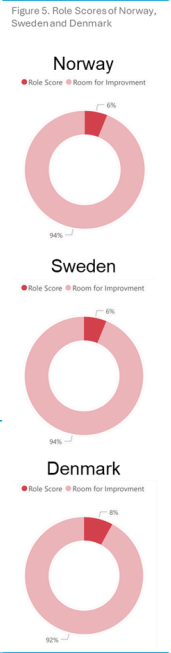

Several factors contribute to the overall deficiency in ESG expertise across Norwegian boards. The most significant area of weakness is the role score, which evaluates directors’ professional backgrounds in sustainability-related positions. A concerning 94% of Norwegian boards fall short of the average performance benchmark, underscoring the need for urgent improvement. The assessment also revealed that Norwegian boards heavily rely on academic qualifications, particularly in sustainability-related fields. While formal education is valuable, it is insufficient by itself to ensure robust ESG governance. Practical experience in implementing sustainable business practices is equally, if not more, important. This imbalance highlights a gap in professional sustainability experience that needs to be addressed through targeted board training and development programs.

The findings also suggest that Norwegian companies have significant room for growth in other key governance areas, such as service experience and committee engagement. No Norwegian board scored above 50% in the committee score, indicating that many lack the formal structures necessary to drive sustainability initiatives effectively. Without well-functioning committees dedicated to sustainability, boards may struggle to set realistic targets or effectively oversee their company’s ESG strategies. This underperformance in critical governance functions creates vulnerabilities that could hinder long-term success in a world where sustainability is becoming a non-negotiable business imperative.

In conclusion, Norwegian boards are at a crossroads when it comes to integrating sustainability into their governance frameworks. While there are some positive examples, such as Wilh. Wilhelmsen, most boards are struggling to meet the demands of the modern corporate governance landscape. The need for enhanced boardroom competencies in sustainability is clear, as global regulations and investor expectations continue to evolve. Addressing these gaps will require a multi-pronged approach, including targeted training, diversification of board expertise, and a more robust focus on practical experience in sustainability initiatives. Without such efforts, Norwegian companies may find themselves falling behind in a rapidly changing global marketplace.

For the full report, please visit: Norwegian Boards: Facing an ESG Expertise Crunch (cbs.dk)

About the Authors:

Prof. Kristjan Jespersen is an Associate Professor in Sustainable Innovation and Entrepreneurship at the Copenhagen Business School (CBS). Kristjan is an Associate Professor at the Copenhagen Business School (CBS). As a primary area of focus, he studies the growing development and management of Ecosystem Services in developing countries. Within the field, Kristjan focuses his attention on the institutional legitimacy of such initiatives and the overall compensation tools used to ensure compliance. He has a background in International Relations and Economics.

Walter Bachmann is an ESG Research Assistant at Nordic ESG Lab and a master’s student in Finance and Investments at Copenhagen Business School. He holds a bachelor’s degree in International Business Administration from Tallinn University of Technology, graduating with First Class Honors. Before joining Nordic ESG Lab, Walter worked as an M&A Analyst at LNP Corporate Finance, where he actively participated in deals from start to finish. He is proficient in developing complex financial and valuation models, as well as creating investor and client presentation materials. This year, Walter is focusing on sustainability by pursuing a minor in ESG at Copenhagen Business School. He is also actively involved in Oikos Copenhagen, a student-led initiative promoting collaboration for a sustainable future.

Naomi Villaruel holds a Bachelor of Commerce & Accounting degree from the University of Galway in Ireland where she completed an internship at KPMG Dublin. She furthered her expertise as an ESG & Business Development Associate at Nossa Data, an ESG Reporting SaaS startup in London, where she assisted companies with their non-financial reporting and disclosures. This year Naomi is commencing a Master’s degree in Environment & Resource Management specializing in Ecosystem Services & Biodiversity at Vrije University in Amsterdam.