By Antonia Föger, Sebastian Rottensten Wieghorst and Prof. Kristjan Jespersen

Our world’s oceans cover more than 70% of the Earth’s surface and represent one of its most critical ecosystems. They absorb around 90% of global excess heat, provide food and employment for millions of people worldwide and create economic value that is comparable to the world’s seventh largest economy. Recognizing the importance of oceans for the environment, society, and the economy, it is surprising that investments in sustainable ocean initiatives, often termed ‘blue finance,’ lag behind land-based counterparts. SDG 14, focusing on ocean-related sustainability goals, receives the least public funding among all Sustainable Development Goals. Additionally, in the realm of ESG investing, oceans are yet to receive the attention they deserve.

This imbalance can be attributed to several barriers in ocean investment. A significant issue is the lack of relevant ESG data and ‘blue metrics’ for evaluating the impact and risk of ocean-related investments. Currently, ESG data providers do not offer sufficient ocean-focused scores and indicators, hindering the assessment of a company’s conduct in terms of ocean health, including marine pollution, overfishing, or operations in marine protected areas. Moreover, private and institutional investors often perceive ocean-positive investments as riskier and lack viable investment frameworks.

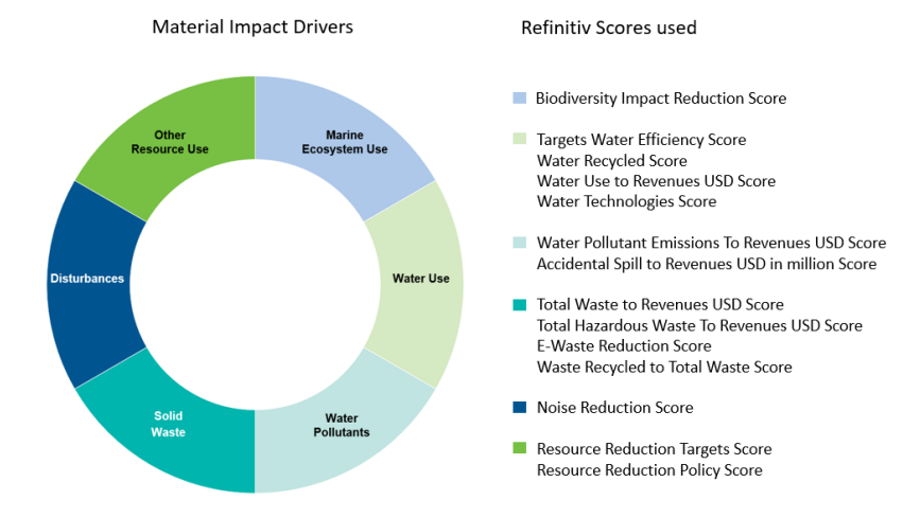

To address these gaps, our Master’s Thesis, supervised by Kristjan Jespersen, conducted a study analyzing the performance of three self-constructed ocean sustainable public equity portfolios using various ESG investment strategies. We tackled the lack of ocean-specific sustainability data by creating our own Ocean Impact Score (OIS). We assessed natural impact drivers for each GICS sub-industry, aligned with the TNFD framework, and overlay this with industry assessment using the ENCORE tool. We then matched these material ocean impact drivers with available environmental scores at Refinitiv to create the OIS.

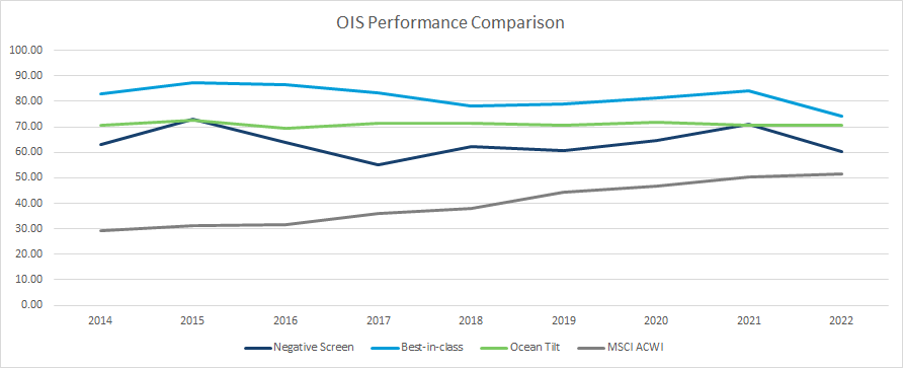

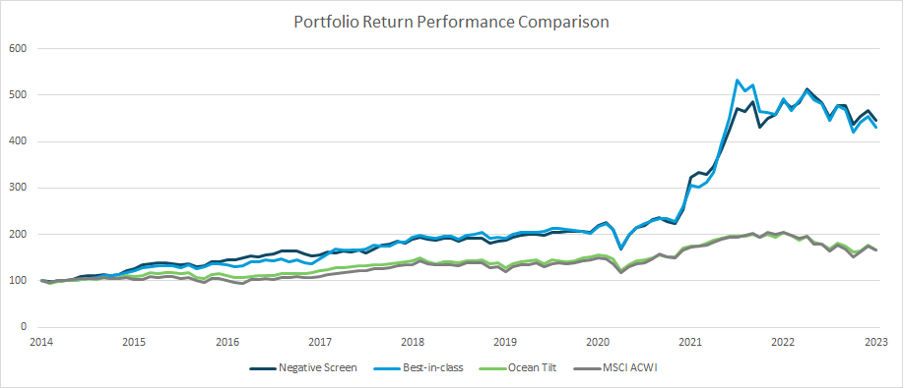

Our study evaluated the financial and OIS performance of these portfolios compared to the market. We explored three ESG investment strategies commonly used: negative screening, best-in-class, and ocean tilt. These strategies demonstrate how to integrate OIS data, along with their benefits and potential pitfalls, while comparing them to the MSCI All Countries World Index (MSCI ACWI).

Our results indicate that investors can enhance the ocean sustainability of their portfolio without sacrificing risk-adjusted financial performance. All three ocean portfolios consistently outperformed the benchmark in terms of OIS performance, with the negative screened and best-in-class portfolios showing superior financial performance in seven out of nine analyzed years. We also identified small but significant alpha values of 1.1% and 1.0% in the two portfolios, suggesting that screening companies based on ocean impact performance can yield positive abnormal returns compared to the MSCI ACWI. While our study does not establish a direct causal link between ocean sustainability and financial performance, it demonstrates that integrating ocean sustainability in investment decisions does not necessarily result in lower returns.

An interesting observation is that none of the three ocean portfolios showed improvement in their Ocean Impact Score over time, while the benchmark consistently improved year after year. This raises questions about what ESG score improvement actually measures. The limited ESG disclosure available suggests that the OIS score’s improvement might result from better disclosure practices rather than actual improvements in ocean-related environmental performance. Consequently, companies with high-quality environmental disclosure in the early years tend to maintain their OIS scores without significant changes. Therefore, the overall market improvement is likely driven by advancements in disclosure practices.

Our study’s results demonstrate that investors can already reduce the negative ocean impact of their portfolios while maintaining similar or even slightly higher risk-adjusted financial performance. Additionally, assessing the ocean impact of portfolios enables investors to engage actively with companies lagging behind in environmental performance.

About the authors

Antonia Föger is a recent graduate of MSc in Finance and Strategic Management (Cand. Merc.) from Copenhagen Business School. Her focus during her master’s thesis has been on sustainable finance, reflecting her enthusiasm for integrating environmental and social considerations into investment decisions and the associated challenges.

Sebastian Rottensten Wieghorst is a recent graduate of MSc in Finance and Strategic Management (Cand. Merc.) from Copenhagen Business School. His interest in the overlap between asset management and sustainability motivated him to contribute to unexplored facets within the field of ESG investing.

Prof. Kristjan Jespersen is an Associate Professor in Sustainable Innovation and Entrepreneurship at the Copenhagen Business School (CBS). Kristjan is an Associate Professor at the Copenhagen Business School (CBS). As a primary area of focus, he studies the growing development and management of Ecosystem Services in developing countries. Within the field, Kristjan focuses his attention on the institutional legitimacy of such initiatives and the overall compensation tools used to ensure compliance. He has a background in International Relations and Economics.