By Katryn Pasaribu and Prof. Kristjan Jespersen

Tropical deforestation has been targeted as the primary driver of agricultural-induced deforestation. Consequently, the conservation of remaining natural forests is an internationally growing concern. However, even though multi-billion-dollar initiatives have been poured out for nature-based solutions to address climate change, including the protection of forests or biodiversity, recent studies suggest that conservation is underfinancing due to the lack of continuity or a steady flow of funds for every single forested spot around the world (Barral, 2021; Bos et al., 2015; Phelps et al., 2011). Thus, the question of how to link financing for conservation and the business value chain is substantial. An ambitious research project, “No Trees, No Future – Unlocking the Full Potential of Conservation Finance,” funded by the David and Lucile Packard Foundation, seeks to design and test a rigorous methodology that addresses the linkage between the private sector’s contribution to conservation financing and their value chain.

At the same time, the current progression of the EU Corporate Sustainability Reporting Directive compels companies to disclose, identify, and describe their environmental risk and opportunities for the whole value chain, including topics such as emissions (climate change) and biodiversity. Companies are expected to develop targets and policies and to measure their accomplishments accordingly. This condition means the report should be comparable over time (historical progression), verifiable (geo-location), and understandable (measurable). With this current development in regulation, companies need serviceable methods to address the requirements. We find that the spatial footprint approach developed through the “No Trees, No Future” project affixes the two unrelated issues, conservation finance and companies’ sustainability reporting, and turns the two issues into two sides of a coin.

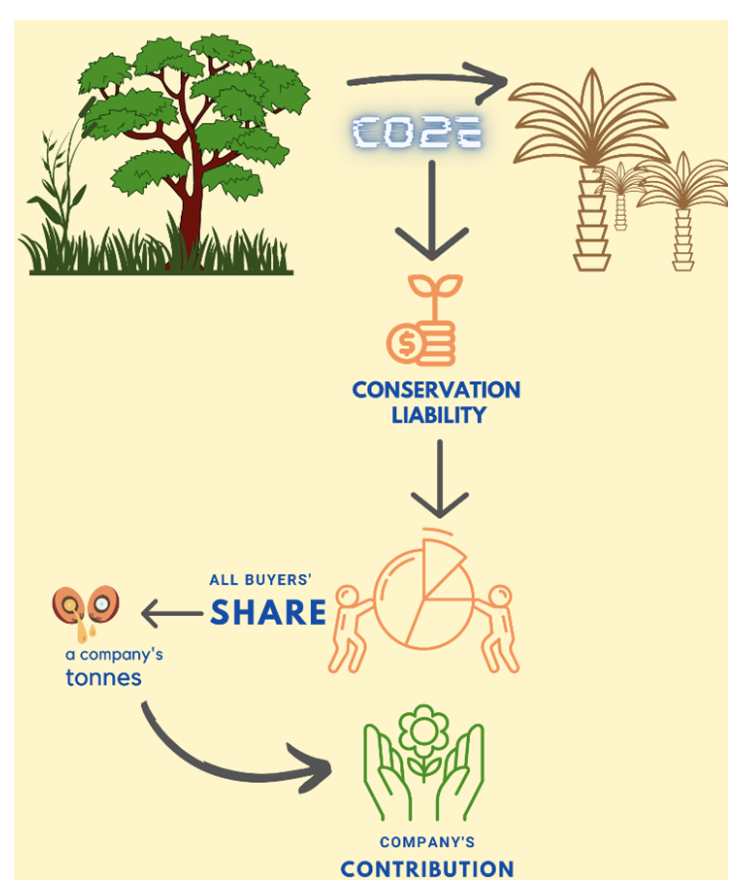

The methodology generally consists of a spatial analysis, a forest cover loss-to-emission conversion calculation, an assessment of carbon-based pricing impact evaluation, and an analysis of benefits-based burden-sharing guided by economic benefits. Figure 1 below explains the process of the spatial footprint analysis for conservation finance.

Figure 1. Animation of the analysis process of spatial footprint analysis for conservation finance

The methodology starts with spatial analysis. The spatial analysis identifies the deforested spots within the agricultural concession. In this analysis, leakage or spillover conversion is not counted to have a clear-cut linkage between business activities and their direct impact. The empirical work of this research project centers on the spatial information of oil palm concession as the object of analysis. The spatial analysis results in deforested spots within the oil palm concession by overlaying the global forest cover map, annual forest cover loss map, and oil palm concession map. The next step involves translating the biomass loss from deforested spots into emissions. The deforested spots map is overlayed with the above-ground biomass map, resulting in the estimated above-ground biomass loss from the deforestation within the concession. The total emission arising from deforestation is calculated using the biomass-emission conversion rate. The third step is calculating the monetary value of the calculated emission using the carbon price mechanism; in this research, a carbon tax is used. From this third step, the dollar value of the total fund can be interpreted as the amount of conservation funds that should be allocated back to the region where the concession is in place.

Nevertheless, the oil palm buyers should not entirely be burdened by the dollar value because the burden should be distributed based on the benefits received (Hayward, 2012; Page, 2008). The conservation burdens should be proportionally shared between producers and buyers based on the economic benefits received. Thus, the buyers’ responsibility for conservation is proportionately calculated based on the market surplus received by the buyers within the palm oil market transaction. An individual buyer’s tonnage of palm oil is used to calculate the individual buyer’s shares. The last step is replicable for every chain in the whole value chain of the oil palm industry. Thus, the contribution is distributable throughout the value chain.

The spatial analysis covers the EU-CSRD requirement regarding environmental impact analysis, especially biodiversity-related issues, such as land use change impact. The forest loss-to-emission calculation covers the EU-CSRD requirement regarding climate change mitigation (emission) related issues. The emission pricing also helps companies translate their impacts in terms of monetary value, which the recent regulation requires. Thus, the spatial footprint approach addresses the reporting requirement and explores a strategy of financing mechanisms for conservation throughout business value chains.

The next question will be, will the identified fund be enough? What will be the possible implications once the “burdens” are identified? Intuitively, the identified fund is insufficient because the pricing does not factor in the value of ecosystem service loss or biodiversity loss from the forest conversion. However, this method covers proxy and emission, which is, at the moment, globally acknowledged. The possible implication, once the burden is identified for every region of oil palm producers, is sourcing shifting due to the different magnitude of the dollar value of the “burden” of each region. Without regulation in place being enforced, the dynamic of sourcing shifting may backfire on the forest conservation goal.

References

Barral, S. (2021). Conservation, finance, bureaucrats: managing time and space in the production of environmental intangibles. Journal of Cultural Economy, 14(5), 549–563. https://doi.org/10.1080/17530350.2020.1846593

Bos, M., Pressey, R. L., & Stoeckl, N. (2015). Marine conservation finance: The need for and scope of an emerging field. Ocean & Coastal Management, 114, 116–128. https://doi.org/10.1016/j.ocecoaman.2015.06.021

Phelps, J., Webb, E. L., & Koh, L. P. (2011). Risky business: an uncertain future for biodiversity conservation finance through REDD+. Conservation Letters, 4(2), 88–94. https://doi.org/10.1111/j.1755-263X.2010.00155.x

Hayward, T. (2012). Climate change and ethics. Nature Climate Change, 2(12), 843–848. https://doi.org/10.1038/nclimate1615

Page, E. A. (2008). Distributing the burdens of climate change. Environmental Politics, 17(4), 556–575. https://doi.org/10.1080/09644010802193419

About the authors

Katryn is a postdoctoral researcher at Copenhagen Business School. Katryn received her Ph.D. in Natural Resource Economics from the University of Tennessee, her MS in Agricultural and Applied Economics from the University of Wyoming, and her BA in Economics from the University of Indonesia. Her research interests are Environmental and Natural Resource Economics, Sustainable Production, Rural Development, and Environmental Carrying Capacity. Currently, she is working on a Conservation Finance research project named “No Tree – No Future”.

Prof. Kristjan Jespersen is an Associate Professor in Sustainable Innovation and Entrepreneurship at the Copenhagen Business School (CBS). Kristjan is an Associate Professor at the Copenhagen Business School (CBS). As a primary area of focus, he studies the growing development and management of Ecosystem Services in developing countries. Within the field, Kristjan focuses his attention on the institutional legitimacy of such initiatives and the overall compensation tools used to ensure compliance. He has a background in International Relations and Economics.