By Dr. Kristjan Jespersen, Prof. Jennifer Lee, and Lise Pretorius

Conversations around sustainability have consistently emphasized that boards of directors can easily facilitate or delay the green transition in corporations. In the earlier years, the question of interest had been how to win the boards’ support when integrating sustainability goals into business, because many boards viewed sustainability as a barrier to maximize profit. Recently, with consistent evidence that sustainability can directly improve long-term profitability of firms, investors and executives successfully have gotten the board behind sustainability efforts.

Yet, ensuring good ESG performance requires not just the support of the boards, but also their expertise in both the science and regulatory landscape of sustainability. A board with suitable expertise can improve ESG performance by exercising proper oversight over existing ESG policies; advising on formulation and execution of new practices; and reorienting the business per fast-changing expectations from stakeholders and regulations. Currently, companies are facing unprecedented needs for ESG-competent boards for two reasons. First, many ESG evaluation systems are updating their evaluation criteria to be more stringent and scientifically rigorous. To maintain positive ESG ratings and thus remain credible in the eyes of investors, it has become imperative for firms to have boards with a tight grasp of the science behind the maturing criteria and methodologies behind ESG evaluation systems. Second, companies are under increasing pressure from new initiatives emerging at EU-level that highlight the role of the boards. For example, the upcoming Corporate Sustainability Due Diligence (CSDD) regulation explicitly articulates that the boards of directors should be assessed and compensated based on their contribution to ESG outcomes. This means that companies need appropriate tools to gauge the board’s performance regarding ESG outcomes, as well as to fully harness the board’s ESG competency. Other EU regulatory initiatives, such as Green Deal and EU Taxonomy, also highlight how the expertise of the board is crucial in decarbonizing business models, managing social impacts, and increasing resilience against climate change, urging companies to form ESG-competent boards.

The problem we face

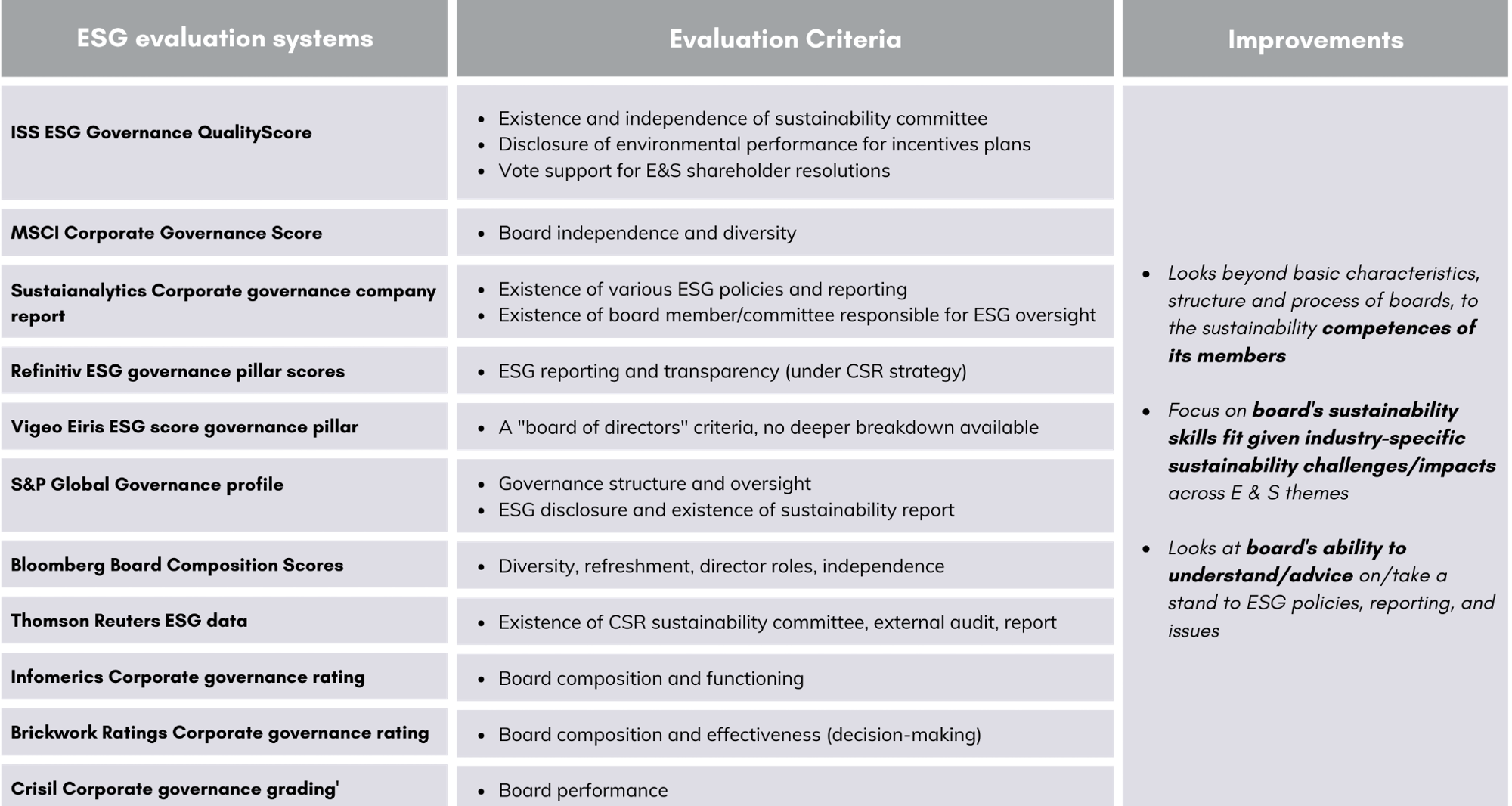

Despite such pressing needs, investors and executives are lacking methodologies and data to understand a board’s ability to tackle the sustainability challenges a company faces. To date, few have considered the notion of “ESG readiness” beyond the board-level quality of oversight. For example, major global ESG data providers such as Refintiv, MSCI, and ISS, assess boards’ ESG-competency simply based on whether a sustainability committee exists, whether the board publishes sustainability reports, or in a few cases, whether ESG performance is considered for incentive plans. While such factors are essential components to ensure an ESG-ready board, it is unlikely that an existence of a committee, report, or remuneration criteria are sufficient to gauge a board’s ability to understand and advise on ESG policies and material issues. In fact, it is the individual directors’ capacity to bring in the knowledge and experience needed to ask the right questions, give advice, and navigate through compliance. To achieve a more fine-grained understanding of a board’s ESG readiness, therefore, understanding the competencies of individual directors–and the board in aggregate – may prove to be valuable.

Finding a way to gauge a board’s sustainability competency

A research initiative by scholars at Copenhagen Business School, along with Matter, a Danish fintech company, is inspired by this insight. Researchers are developing a tool that can help understand boards’ ESG competency by focusing on the credentials of each director. The research team built a dataset on the profiles of all board members on all publicly traded companies in Denmark and all companies listed in the major stock indices in Finland, Norway, Sweden, Germany, and Switzerland. Directors are assessed based on their education background related to sustainability topics and prior professional experience in sustainability-related positions, committees, and organizations. Individual ESG-competency scores are then aggregated based on the methodology that considers the director’s voice within the board (e.g., the director’s age and tenure on the board relative to the rest of the board), as well as the distribution of the ESG-competency within the board (e.g., a board in which majority directors score above-average in ESG-readiness is considered more capable than a board in which a few directors score extraordinarily high in ESG competency). Preliminary analysis on the collected data revealed that boards are still ill-equipped with the requisite ESG expertise for their industries. Our data demonstrates that, for example, over 20% of the companies lack an ESG-competent board, and close to 30% of the companies have directors with minimal ESG competency . Only about 3% of companies have access to a rich source of ESG competence—defined as having more than one-third of the board equipped to tackle ESG challenges with a diverse range of ESG competence among the directors. The data also revealed that there is a substantial variation across sectors – Customer services industry having the lowest ESG credentials among directors, and Biotechnology and Pharmaceuticals sector having the highest by 2.5 times – suggesting that we may need sector-specific approaches to establish ESG competent boards.

So what?

In the face of the growing recognition that the board plays a crucial role in driving companies’ sustainability transitions, this methodology provides useful solutions for both companies and investors. Companies can leverage this tool to:

- Take a pulse check on the ESG competencies required of the current board. Currently, companies lack tools to assess the state of their boards’ ESG competency. This method gives a quick overview of the current ESG credentials a board needs, and helps companies understand whether the board is up for future sustainability challenges.

- Maximize the potential ESG capabilities of the board by deliberately planning board formation. Once companies assess the current state of the board’s ESG competency, they can use this tool to future-proof the board for their ESG needs and challenges. Companies can recruit talent for the specific areas they need expertise for, while diversifying the board to cover a wide range of ESG issues. A wide application of this tool may also help companies overcome the limited talent pool in recruiting directors, as they can now easily identify and engage new talent based on the clearly defined dimensions.

- Ensure alignment with regulatory requirements which mandate that individual directors be assessed and compensated based on their contribution to ESG outcomes. Compliance with initiatives such as CSDD requires substantial learning and adjustments within company governance. With this tool, companies can get a head start on aligning the business with the regulations by implementing the director-level point of view. While companies will need to come up with a system to identify each director’s contribution to the companies’ ESG outcome, the data points on directors’ expertise lay out the foundation to assess their contribution.

- Rely on a methodology and dataset that is transparent and applicable to all sectors. In evaluating and reporting on ESG efforts and compliance, investors are increasingly looking for datasets and methodologies that are rules based and transparent. This is critical in ensuring that insights on companies can be understood and explained to financial regulators and wider stakeholders. This methodology applies to companies across all sectors, while at the same time incorporating sector-specific criteria for material issues, such that key methodological and aggregation choices, can be clearly understood and integrated by finance sector stakeholders.

- Integrate a unique datapoint into ESG assessments of companies’ transition plans. Understanding what boards can provide in guiding companies green transitions is important for investors to predict whether transition plans are credible. This tool helps investors understand whether the companies are properly equipped to set the right targets, advise on the necessary strategic changes, and to re-imagine business models where necessary given the set of sustainability challenges changing the landscape for each sector.

- Ensuring that ESG competencies of the board maximize the company’s ability to meet commitments and targets, and identify areas of engagement where relevant. In the long-run, investors can use this tool to maintain and improve the ESG competency of the board to ensure long term plans are delivered. With every addition and removal of a board member, investors now have a simplified way of understanding how the board’s ESG competency changes, and of urging the firm to form the board with appropriate expertise.

About the authors

Prof. Kristjan Jespersen is an Associate Professor in Sustainable Innovation and Entrepreneurship at the Copenhagen Business School (CBS). Kristjan Jespersen is an Associate Professor at the Copenhagen Business School (CBS). As a primary area of focus, he studies the growing development and management of Ecosystem Services in developing countries. Within the field, Kristjan focuses his attention on the institutional legitimacy of such initiatives and the overall compensation tools used to ensure compliance. He has a background in International Relations and Economics.

Lise Pretorius is the the Head of Sustainability Analysis at Matter. She is an environmental economist whose work is about merging the traditional fields of economics, finance and business with innovations in sustainability and systems thinking. Her focus is on the role of investment in creating systemic change, making the business case for corporate sustainability, and the potential for “beyond GDP” measures of progress to create an economic model more capable of dealing with 21st century challenges.

Prof. Jennifer Lee is an assistant professor in Organizations, Strategy, and International Management at the University of Texas at Dallas. Her work is in the area of corporate governance, focusing on the external pressures firms face such as the threat of shareholder activism.