by Jasmin S. Petersen, Louise H. Nielsen, Sabine S. Hansen, Kedar Uttam and Prof. Kristjan Jespersen

Environmental, social, and governance (ESG) factors have become crucial for promoting sustainable business practices, with investors increasingly recognizing the link between environmental impacts, social responsibilities, corporate governancem and potential risks and opportunities. Consequently, ESG scores are now integral to investment strategies worldwide. While the impact of higher ESG scores on company value has garnered attention, there is limited analysis specific to sectors. The European Healthcare being significant to public health and societal well-being, presents an excellent opportunity to expore the relationship between ESG scores and stock prices. Specifically, ESG indicators such as environmental (e.g. harmful emissions and waste) and social (e.g. heavy workloads) challenges associated with this sector, offer a compelling opportunity to explore this important relationship focused on stock performance and ESG. Our study aimed to investigate the effect of ESG scores on stock prices of 104 European Healthcare companies from 2015 to 2021. Through rigorous statistical analysis, we examined the correlation between ESG scores and stock prices, considering the individual pillars (environmental, social, and governance) separately.

Impact of ESG scores on European Healthcare Companies’ Stock Prices

In this study, we conducted a comprehensive analysis of the relationship between ESG scores and stock prices in the European Healthcare sector. To achieve this, we utilized rigorous statistical techniques along with a thorough literature review Our primary goal was to isolate and evaluate the individual impact of each pillar (environmental (E, social (S), and governance (G)) on the companies’ stock prices within the sample. To carry out this investigation, we employed regression analysis carefully assessing the relationship between E,S, and G pillar scores and the corresponding stock prices of the companies. The ESG scores used in our statistical model were sourced from the MSCI database while financial data came from the Refinitive Eikon database. Our findings revealed that none of the individual pillars – E,S,G – exhibited a statistically significant effect on the stock prices of the companies.

The model’s results showed that a higher E/S/G pillar score had neither a positive nor a negative effect on the company’s stock prices, indicating that they receive no tangible financial benefits from investing in ESG. It is essential to acknowledge that our model has limitations; it cannot illustrate a hypothetical scenario of how the companies’ stock prices might have performed if they had not pursued improvements in their ESG pillar scores.Despite these unexpected results, which conflicted with previous research linking ESG-consciousness to higher market performance, our analysis provides valuable insights into the unique dynamics of ESG in the European Healthcare sector.

ESG Scores’ Trajectory

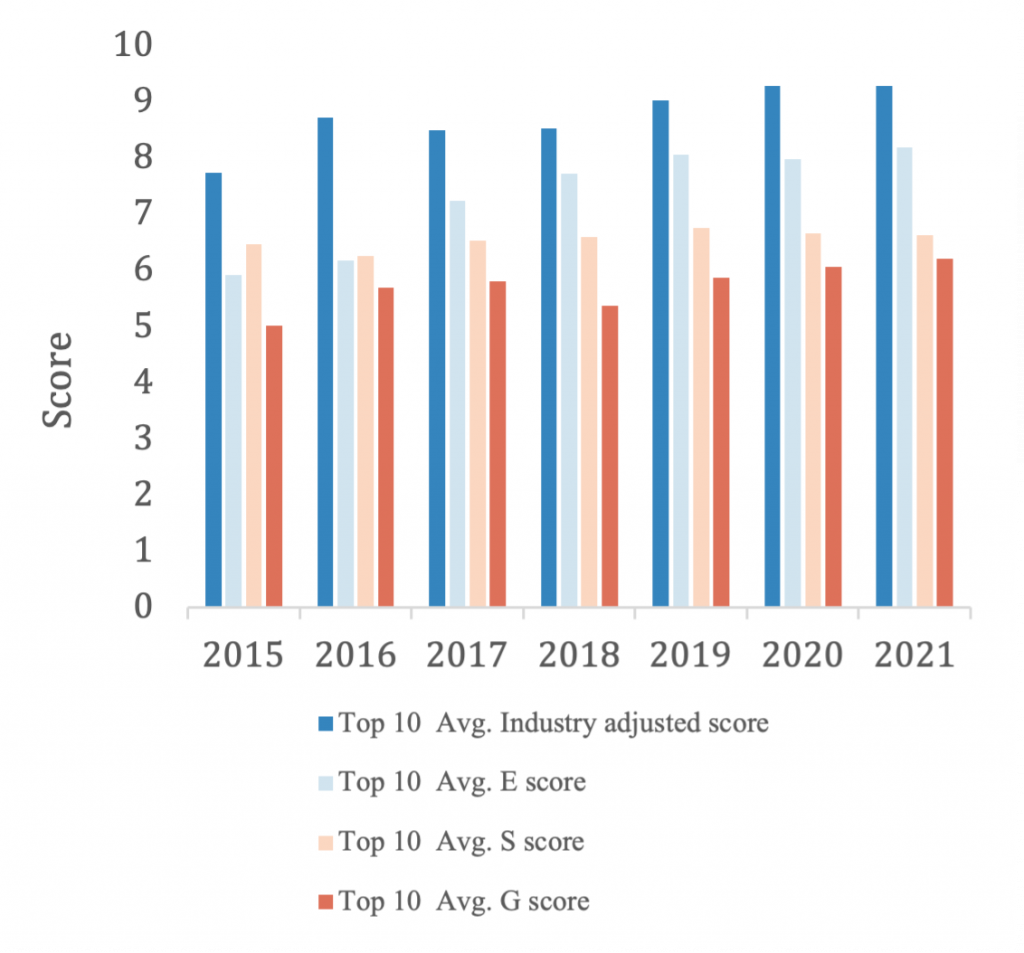

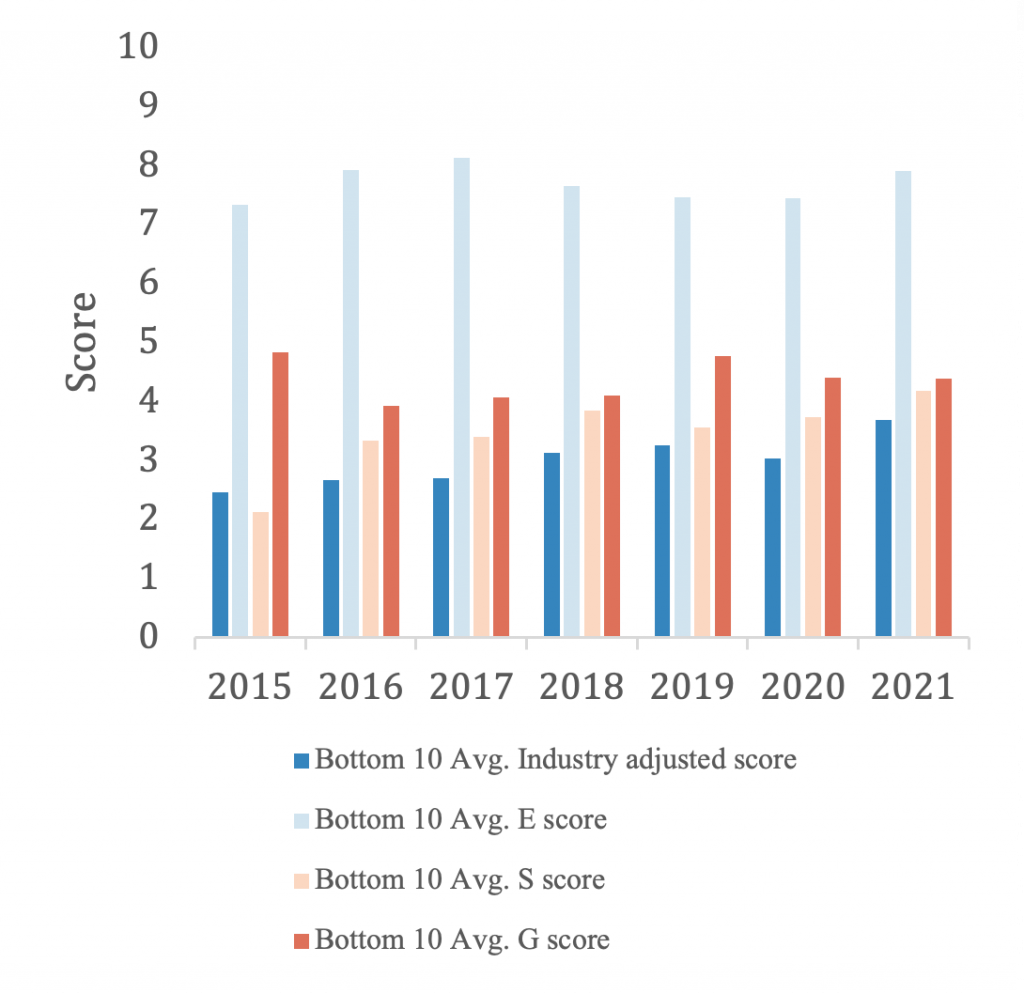

The ESG score data utilized to develop our model exhibited an intriguing trend within the European Healthcare sector. Both the industry-adjusted ESG score, which measures company’s ESG management relative to industry peers facing similar ESG risks, and the the individual pillar scores showed consistent improvements over the study period. Notably, all individual pillar scores experienced growth of over 10% during this time, with advancements observed among both the top10 and bottom10 performers (see Figure 1). These findings indicate that the healthcare sector is actively adapting to the evolving sustainability regulations in the European Union, as evidenced by their dedicated efforts to enhance ESG performance. Despite the absence of immediate financial benefits, companies in the sector have still chosen to invest in ESG activities, recognizing various non-pecuniary advantages that are equally, if not more, crucial in today’s business landscape. ESG scores have emerged as a powerful symbol of a company’s commitment to sustainable business practices. By elevating their ESG scores, European healthcare companies aim to demonstrate their unwavering dedication to addressing ESG issues. This commitment, in turn, serves to enhance their legitimacy, align with stakeholder interests, and respond to institutional pressures. Such proactive engagement with ESG dimensions reflects a strategic choice made by these companies to remain at the forefront of responsible and sustainable business practices in the healthcare industry.

Figure 1: Average ESG scores for Top 10 and Bottom 10 companies in the sample

Through an exhaustive literature review, we have ascertained that robust ESG performance plays a pivotal role in cultivating a positive reputation, thereby fortifying stakeholder trust and nurturing enduring relationships with investors, customers, employees, and other stakeholders. Notably, healthcare companies appear to be cognizant of the far-reaching advantages that emanate from a steering reputation and the trust bestowed upon them by stakeholders. ,

Recommendations

The pursuit of ESG efforts presents a notable challenge for healthcare companies, given the resource-intensive nature of the sector. While these companies are motivated by“non-pecuniary rewards” [3] to enhance their ESG scores, mere adherence to generic ESG commitments may translate into significant improvements in market value enhancements. To unlock tangible financial benefits and gain a competitive edge, healthcare firms must move beyond mere compliance and adopt a strategic approach tailored to their unique sub-industries. A generic approach to ESG issues may have certain limitations, especially in effectively addressing societal objectives outlined by the UN Sustainable Development Goals (SDGs). However, by discerning between financially material ESG issues related to the SDGs and those that lack financial impact, healthcare companies can identify areas where they have the potential to act in line with the SDGs, even in the absence of direct incentives [4]. Strategic targeting of such areas can yield the most favorable outcomes, positioning them for long-term success

Decarbonization of healthcare emerges as a crucial initiative that merits incentivization[5]. Rather than treating ESG as a box-ticking exercise, healthcare firms should embrace a proactive stance demonstrating superior ESG performance. Efficient resource allocation and alignment of ESG practices with core values will contribute to long-term sustainability, bolster market position, and attract responsible impact investors. Embracing ESG as a strategic imperative, healthcare companies can not only address pressing societal challenges but also fortify their market standing, signaling a profound commitment to sustainable practices.

Future of ESG in the Healthcare Sector

The changing landscape of regulatory standards will usher in a transformative shift in the role of ESG scores for healthcare companies. As these companies integrate ESG considerations into their core business strategies, they will not only bolster their resilience in navigating market shifts but also contribute significantly to the broader mission of sustainable development. The implications of growing number of regulations on the healthcare sector are far-reaching [6]. ESG principles are becoming deeply ingrained in corporate practices, placing mounting pressure to adopt sustainable and socially responsible business models. Investors increasingly weigh ESG performance in their decision-making, rewarding companies that prioritize sustainability. Consequently, companies that fail to meet these evolving ESG standards may encounter difficulties attracting capital and investors.

By proactively embracing ESG initiatives, healthcare organizations can secure a competitive advantage, positioning themselves at the forefront of evolving regulations. Such companies will be better positioned to attract socially conscious investors and forge partnerships with like-minded businesses, elevating their reputation among customers and the broader community. Moreover, aligning with ESG principles opens up new avenues for innovation, propelling the development of eco-friendly medical technologies and solutions.

As the healthcare sector responds to these regulatory changes, embracing ESG as an integral part of their operations will not only contribute to the industry’s sustainability but also lead to long-term growth and success. By aligning business practices with evolving ESG standards, healthcare companies can actively drive positive change while solidifying their position as responsible leaders in the pursuit of sustainable development.

Sources

- Pizzutilo, F. 2023. Is ESG-ness the vaccine?, Applied Economics Letters, 30:4, 484-487,

- Feng, J,JW Goodell,D Shen.2022. ESG rating and stock price crash risk: Evidence from China, Finance Research Letters, Volume 46, Part B.

- Laura T. Starks (2021) Environmental, Social, and Governance Issues and the Financial Analysts Journal, Financial Analysts Journal, 77:4, 5-21.

- Consolandi, C., Phadke, H., Hawley, J., & Eccles, R. G. (2020). Material ESG Outcomes and SDG Externalities: Evaluating the Health Care Sector’s Contribution to the SDGs. Organization & Environment, 33(4), 511–533.

- Health Care Without Harm & Arup. 2022. Designing a net zero roadmap for healthcare – Technical methodology and guidance. Available at https://noharm-europe.org/sites/default/files/documents-files/7186/2022-08-HCWH-Europe-Designing-a-net-zero-roadmap-for-healthcare-web.pdf

- Czeschik, C. Coming soon: Sustainability reporting for hospitals. Healthcare.in.europe.com. Available at https://healthcare-in-europe.com/en/news/sustainability-reporting-hospitals-CSRD.html

About the Authors

Jasmin S. Petersen is employed as an Assistant Associate at PwC, specializing in corporate sustainability. She recently obtained a bachelor’s degree in European Business from Copenhagen Business School (CBS).

Louise H. Nielsen is employed as a Finance Assistant at ejendom.com, a SaaS start-up for operations and maintenance of properties. She recently obtained a bachelor’s degree in European Business from Copenhagen Business School (CBS).

Sabine S. Hansen is employed as a Junior Data Scientist at Acceleration Nordic, specializing in optimizing businesses and supporting data-driven decision-making. She recently obtained a bachelor’s degree in European Business from Copenhagen Business School (CBS).

Kedar Uttam is a Postdoc in ESG and the ocean economy and works at the Department of Management, Society and Communication (MSC), Copenhagen Business School (CBS).

Prof. Kristjan Jespersen is an Associate Professor in Sustainable Innovation and Entrepreneurship at the Copenhagen Business School (CBS). Kristjan is an Associate Professor at the Copenhagen Business School (CBS). As a primary area of focus, he studies the growing development and management of Ecosystem Services in developing countries. Within the field, Kristjan focuses his attention on the institutional legitimacy of such initiatives and the overall compensation tools used to ensure compliance. He has a background in International Relations and Economics.

This blogpost is primarily based on a Bachelor’s thesis submitted by Jasmin S Petersen, Louise H Nielsen and Sabine S Hansen. The thesis received the Annual Best European Business Bachelor’s thesis Project 2023 Award under the category “Most European Business focused Bachelor thesis”. The thesis supervisor is Kedar Uttam, Department of MSC, CBS, with the voluntary guidance on statistical analysis: Katryn Pasaribu, Department of MSC, CBS.