By Prof. Kristjan Jespersen, Ella Alette Jakobsen, Anna Sophia Burri, Oda Solend and Constantin Zeithammer

The 2024 US election took place against the backdrop of global climate talks at COP29, with the US playing a pivotal role in international climate action. The election represents a make-or-break moment for US climate ambitions: a continuation of climate commitments under Harris, or a rollback of policies such as the Inflation Reduction Act (IRA) under Trump. Since the IRA was enacted in 2022, investments in clean technology and infrastructure have totaled USD 493 billion, a 71% increase compared over pre-IRA levels (Rhodium Group, 2024). For institutional investors, such as asset managers, understanding the impact of the election on US climate policy in general, and the IRA in particular, is critical to asset management decision-making.

This blog examines the results of our research, on whether and how a Democratic victory would have changed the regulatory climate landscape, and the impact of three election outcome scenarios (retained, repealed, or partially repealed IRA) on the technology and consumer goods sectors. The focus was on the technology sector and the cyclical consumer goods sectors as these are among the industries most affected by the IRA. Our research focused on two companies within each sector, to illustrate how companies are affected differently by the IRA, depending on their core manufacturing activities. The impact of three election outcome scenarios was assessed for Marvell Technology (semiconductor solutions), QuantumScape (solid-state lithium battery production for EVs), Ford (leading automotive manufacturer), and Nike (global leader in consumer sports products).

Main Findings

1. A Democratic victory will lead to a continuation of current US climate policy and the IRA

The Democratic Party has prioritized the climate crisis as a major policy issue and will therefore emphasize continued climate regulation, centered on the key piece of legislation, the IRA. Despite the lack of clear climate action in public statements, Democratic candidate Harris emphasized the urgency of climate change and was expected to support the continuation of climate-related policies such as the IRA. Vice-presidential candidate Walz has a strong history of climate action and was seen as the climate pick among the running mates.

2. The key US climate policy tool of the US, the IRA, will be adjusted rather than repealed entirely

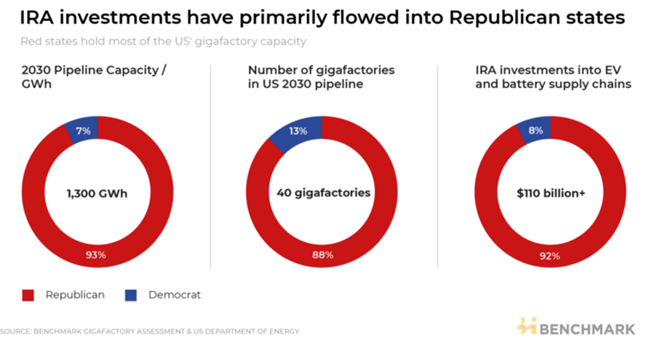

Our analysis further supports the argument that the IRA is likely to be adjusted rather than repealed. This is due to the strong bipartisan and governmental support for the policy, but also due to the fact that IRA investments in clean technologies, such as EV battery manufacturing, have largely gone to Republican states. A potential repeal of the IRA is countered by market dynamics, cost reductions in clean technology, job creation in Republican and Democratic states, and competition with China, a key policy objective for any future administration. The sticky nature of policies already implemented, projects and investments made, and benefits realized creates path dependencies that make a full repeal of the IRA-related investment incentives less attractive to a Republican administration. Moreover, the mismatch between Trump’s policy rhetoric and reality argues against a complete reversal of US climate policy ambitions. During the last Republican presidency, more onshore wind capacity was installed under Trump than under Biden.

Source: Benchmark Source, 2024

3. A partial repeal of the IRA will have a significant but uneven impact on US core industries

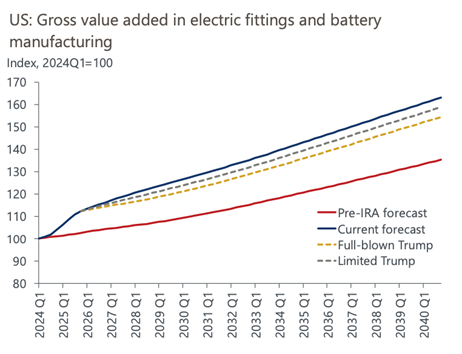

Looking at the US technology and cyclical consumer goods sectors, a partial repeal of the IRA will have a significant but uneven impact on companies. In the technology sector, the withdrawal of investment incentives such as the clean energy or EV tax credits would have a major impact on the growing cleantech industry. This effect would spill over to related technology sectors, particularly battery manufacturing and semiconductor technology which face slower investment growth rates. However, due to their geopolitical importance for national security, supply chain stability, and technological leadership, some cleantech and semiconductor companies are expected to remain a top priority for policymakers and continue their upward trajectory regardless of the election outcome. In the cyclical consumer goods sector, EV manufacturers such as Ford rely heavily on IRA tax credits to support their long-term strategies. The repeal of these credits would reduce competitiveness, although potentially increased fossil fuel production could boost ICE sales. The retail sector is less affected, although ongoing ESG reporting would marginally increase costs.

Source: Oxford Economics/Haver Analytics, 2024

Recommendations for asset managers

First, asset managers should prioritize US investments in industries that enjoy bipartisan and government support, such as companies developing semiconductor technology while reducing exposure to cleantech subsectors that are vulnerable to electoral fluctuations, such as EVs and related battery manufacturing. Second, our analysis suggests prioritizing publicly traded companies in the US technology sector, as they have proven resilient to fluctuations in the climate policy regulatory landscape. Such companies are less vulnerable to a lack of bipartisan support, as well as a rollback of industrial policy or IRA investment incentives.

Asset managers can reduce their portfolios’ exposure to US policy changes by expanding investments in regions with more stable climate frameworks, such as the EU (EU Green Deal) renewable energy initiatives in Southeast Asia.

About the Authors:

Prof. Kristjan Jespersen is an Associate Professor in Sustainable Innovation and Entrepreneurship at the Copenhagen Business School (CBS). Kristjan is an Associate Professor at the Copenhagen Business School (CBS). As a primary area of focus, he studies the growing development and management of Ecosystem Services in developing countries. Within the field, Kristjan focuses his attention on the institutional legitimacy of such initiatives and the overall compensation tools used to ensure compliance. He has a background in International Relations and Economics.

Oda Solend works as a student assistant at Novo Nordisk, supporting a program designed to stimulate innovation in the life science ecosystem by sharing valuable knowledge and expertise with start-ups and academia. She is completing her Master’s degree in International Business and Politics at Copenhagen Business School (CBS), with a minor in ESG, where this project with Nordea Asset Management was developed by her team under the guidance of Professor Kristjan Jespersen. Oda also volunteers with femella, a network organisation empowering female students and young professionals in career and personal growth. She is currently preparing her Master’s thesis on green investments and political risks.

Constantin Zeithammer works as a student assistant in Export Compliance at A. P. Møller-Mærsk and is about to complete his Master’s degree in International Business and Politics at CBS. He holds two Bachelor degrees in Philosophy & Economics from the University of Bayreuth and in Politics, Philosophy & Economics from Charles University in Prague. Previously, Constantin worked in international cooperation for sustainable development at GIZ and in consulting at PwC. His main research interest is the green transition of the automotive industry and related challenges from a political economy perspective, including both market and non-market approaches. Constantin also has a minor in ESG and Sustainable Investments, during which he had the opportunity to develop this project with the team, Professor Kristjan Jespersen, and Nordea Asset Management.