By Jonas Aastrup Nielsen, Andreas Elsgaard, and Prof. Kristjan Jespersen

Does ESG performance have risk protection properties for investors? According to evidence from the Russian invasion of Ukraine, it seems like it.

The European continent has faced significant disruptions as a result of the Russian invasion of Ukraine. This conflict has had profound implications for energy markets, supply chains, inflation rates, and business practices. These geopolitical ripples will only get more important and frequent as the world enters the highest level of geopolitical tension in modern times.

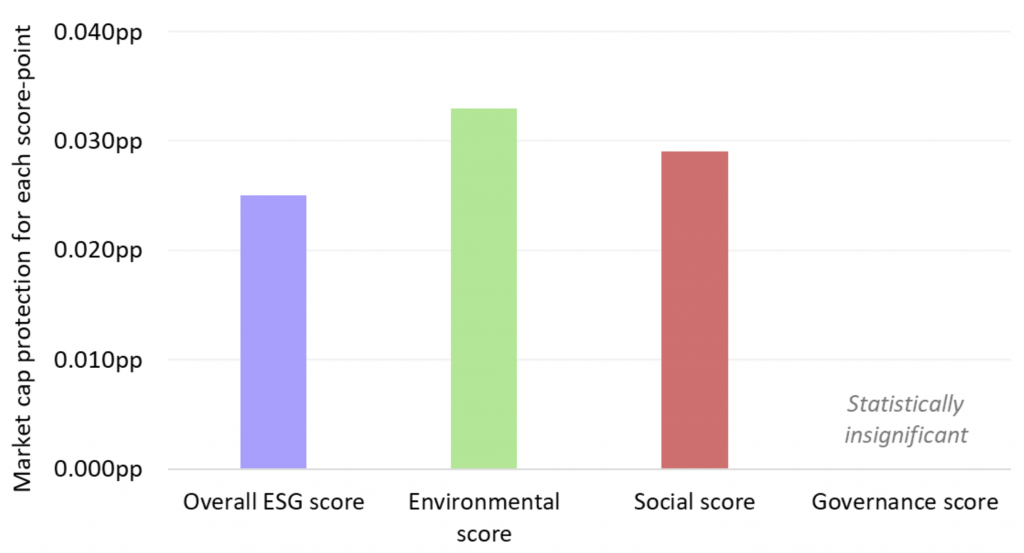

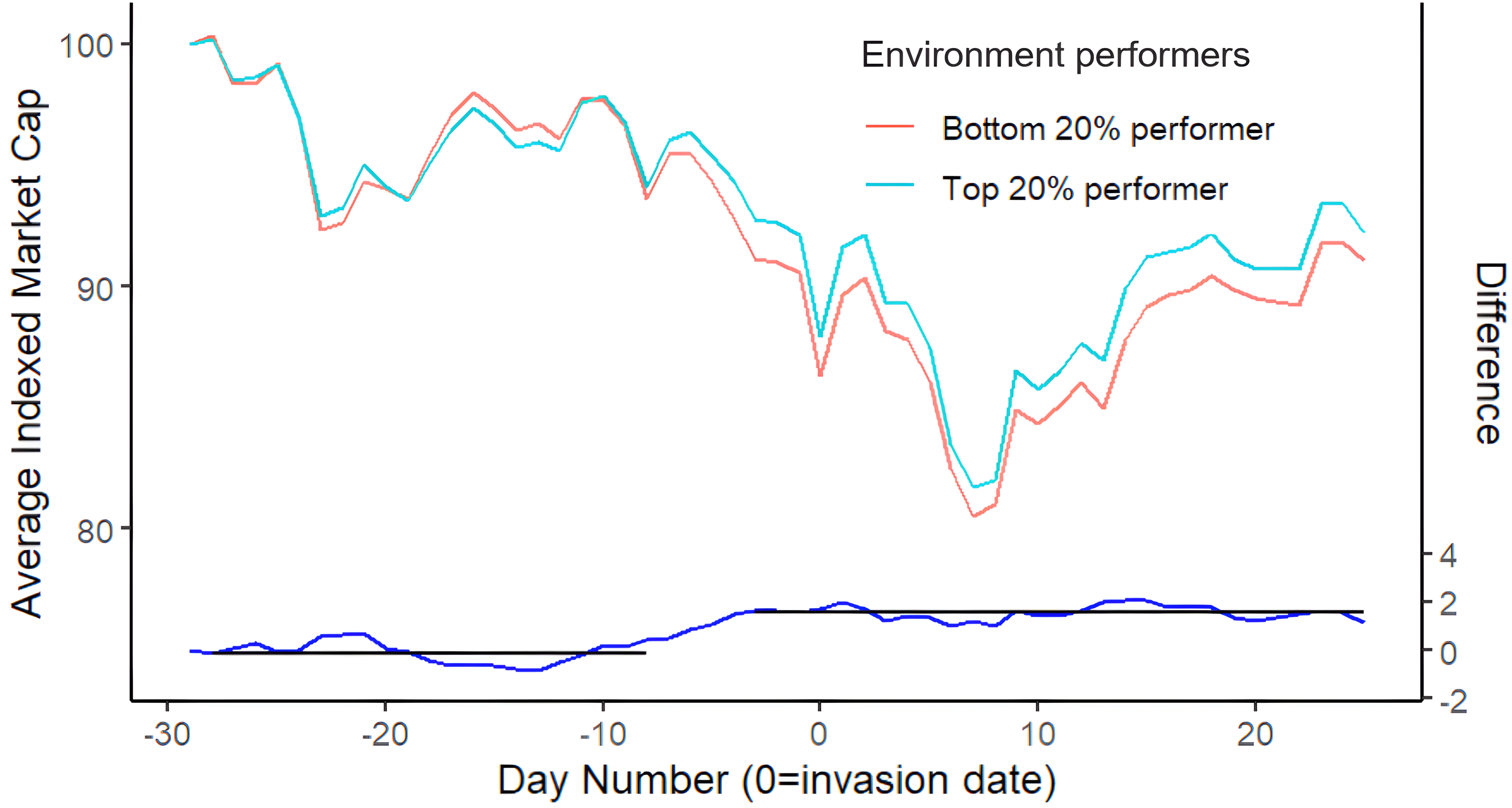

We found that European firms with higher ESG performance were associated with short-term downside protection with firms outperforming by roughly 0,5% of their market capitalization for each 20 ESG score points right after the outbreak of the invasion. The protection was most strongly associated with environmental performance where the protection amounted to 0,66% per 20 Environmental score points. The firm with an environmental score of 80 thus outperformed an identical firm with a score of 20 by 2 percentage points in the short term.

“Do ESG scores have risk protection properties for investors?“

Despite the growing body of literature on ESG, there remains a significant gap in understanding how geopolitical events influence market capitalization, especially with respect to ESG factors. However, this area has never been as important to examine as now where geopolitical tensions are rising globally.

To address this gap, our study employs a novel analytical framework to examine the short-term effects of ESG scores on market capitalization and examine the financial effects of the Russian invasion of Ukraine in the short term. We use a two-way fixed effects difference-in-differences model and a one-month observation window pre- and post-invasion. To capture further nuance, we apply continuous treatment strength across firms.

The study yielded two key findings.

- Firstly, it was observed that ESG factors offered short-term downside risk protection during the initial outbreak of the Russian invasion of Ukraine.

- Secondly, the Environmental sub-pillar of ESG demonstrated a persistent positive protective influence on market capitalization across diverse industries and geographies.

The market response to strong environmental practices highlights the growing importance of environmental considerations in investment decisions.

“Are good sustainability practices actually associated with geopolitical risk protection?”

Our study contributes to the growing body of literature on ESG by providing empirical evidence on the impact of the Russian invasion of Ukraine on the sustainability premium in European markets. The study’s findings highlight the resilience of ESG-oriented firms during periods of geopolitical instability and highlight the persistent positive influence of environmental practices on market capitalization. Between sectors, firms engaged in consumer staples, commodity materials and healthcare were found to have the largest short-term protection.

Geopolitical flashpoints (wars, conflicts, disruptions) will only become more common as global tensions rise. The risks associated with these irregular and uncertain events provide a unique challenge for investors and firms. Are good sustainability practices actually associated with geopolitical risk protection? This question becomes increasingly important to answer.

We propose several directions for future research. Extending the investigation to other geopolitical events and policy implementations would enhance the external validity of this study.

By looking at current conflicts such as the current Israel-Hamas war or other historical geopolitical conflicts, it may be possible to find insights for future conflicts such as any potential conflict between Taiwan and China.

As the world continues to grapple with geopolitical tensions and their economic repercussions, understanding the role of ESG in financial markets becomes increasingly important. Our study offers a valuable starting point for future research in this area, providing insights that can inform investment strategies and policy decisions. Ultimately, our research highlights the growing importance of exploring the interplay between ESG factors and geopolitical events in the analysis of financial markets. By advancing our understanding of the sustainability premium associated with geopolitical uncertainty and its determinants, we can contribute to a more informed and sustainable approach to investment and policymaking, fostering a brighter future for both businesses and society at large.

About the Authors:

Jonas Aastrup Nielsen is a Msc. Finance and Strategic Management graduate at Copenhagen Business School. His research interests are within supply chain disruptions and ESG. He has been working at Simon-Kucher & Partners and is currently at the supply chain and procurement consultancy Prokura as a consultant.

Andreas Elsgaard is a Msc. Finance and Strategic Management graduate with a Minor in Quantitative Methods in Economics, Business and Finance at Copenhagen Business School. His research interests lie within the intersection of finance and sustainability. He has been working at consultancies BCG and EY-Parthenon and is currently at strategy consultancy Monitor Deloitte as a consultant.

Prof. Kristjan Jespersen is an Associate Professor in Sustainable Innovation and Entrepreneurship at the Copenhagen Business School (CBS). Kristjan is an Associate Professor at the Copenhagen Business School (CBS). As a primary area of focus, he studies the growing development and management of Ecosystem Services in developing countries. Within the field, Kristjan focuses his attention on the institutional legitimacy of such initiatives and the overall compensation tools used to ensure compliance. He has a background in International Relations and Economics.