By Michele Sacchi, Bartolomeo Galli, and Kristjan Jespersen1

Introduction

The Critical Minerals (CMs) market is experiencing an exponential. These materials are essential components of modern-day technologies, which are extremely influential in developing the necessary infrastructures to align with Sustainability commitments. The International Energy Agency regularly reports the developments in the CMs markets: its last report has identified the latest list of 50 minerals deemed ‘Critical’. A second categorization deemed central is that of Conflict Minerals, which account for the raw materials extracted in Areas of Conflict, potentially benefiting armed groups.

Both Mineral categories have been analyzed in the project. The Research aims to improve the knowledge of Portfolio Exposure to Critical Minerals, uncovering the most pressing issues and opportunities on which Asset Managers can engage with the Investee Companies. For this reason, the model evaluates the exposure to CMs of a global equity portfolio which includes 30 sustainable companies that operate globally. The Portfolio is built with the assumption that a strong ESG company profile drives for higher, long-term risk-adjusted shareholder returns. The global scope of the portfolio allowed for a comprehensive analysis that focuses on high-level considerations, which can be applied to a variety of industries, rather than having a sector- and region-specific approach.

Understanding CMs industry

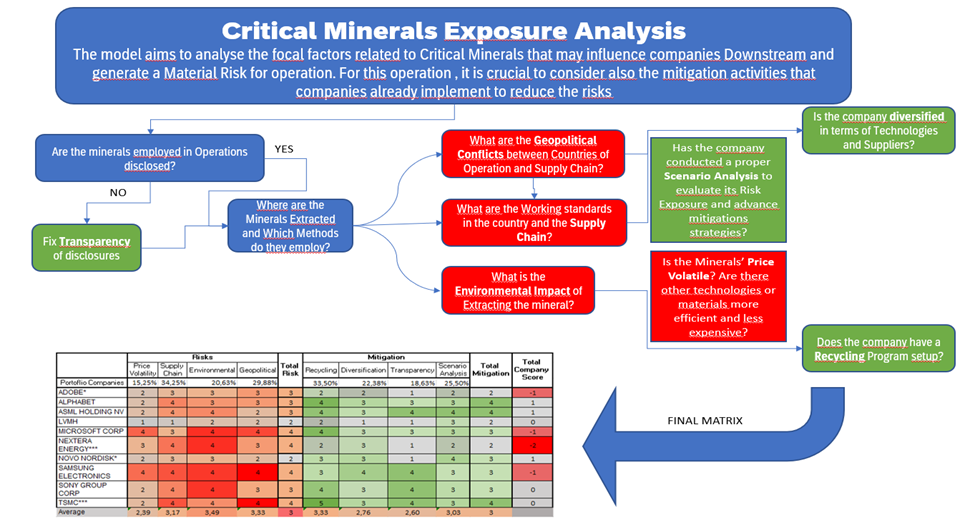

The study’s first objective is to investigate the major risks connected to CMs industry and the operational mitigations. Research suggests that price volatility, geopolitical risk, supply chain risk, and environmental risk are the most important concerns in the industry. First, price volatility is calculated to identify patterns and breakdowns in market prices, using the thresholds provided by the European Commission report in 2014. Second, the geopolitical risk applies a multi-level approach that incorporates different levels of analysis, which aid in measuring the geopolitical landscape that contributes to generating risks for the core business of the investees. Third, the supply chain risk aims to establish the exposure to the Social Issues present in the companies’ supply chains, since the Social dimension is crucial in the extraction industry. Finally, the environmental risk aims to analyze the impact on the environment deriving from extraction. To achieve this, the environmental cost considers the hindered financial impact of extraction, employing a framework created to account for environmental costs in the business plans of mining projects.

As for the mitigation factors, within the companies’ most employed activities, the research identifies recycling, diversification, transparency, and scenario analysis. Recycling is studied as a remedy to reduce the reliance on virgin materials extraction and its value chain. Another mitigative action analyzed is the companies’ efforts to Diversify their Supply Chains, to alleviate the risks deriving from reliance on single suppliers for their needs of raw minerals. The next factor focuses on Transparency, as the process of openly and completely sharing information in a clear way, regarding the sourcing process and supply chain management. Finally, the research accounts for Scenario Analysis, by analyzing the alignment of the Portfolio companies with the Paris Agreement. For this factor, the level of accuracy and plausibility of the companies’ targets and strategies are analyzed.

Model

The second objective is to evaluate the portfolio exposure to CMs. The research uses a risk matrix for evaluating the Total Risk Score and the Total Mitigation Score for companies. These total scores are weighted employing the Expert Judgment approach. This methodology applies an unbiased grading framework to evaluate the most pressing issues regarding CMs. The weighting results show that Supply Chain and Geopolitical factors are considered the most influential risks related to CMs, while Recycling and Scenario Analysis have the highest weights as mitigative actions. Finally, the matrix presents a Total Company Score and a Total Portfolio Score.

Research suggests that the highest exposed companies also tend to exhibit the most robust mitigation strategies. Additionally, the model highlights the elevated influence of environmental and supply chain factors, due to supplier concentration and pronounced social risks associated with extraction processes, as well as a lack of standardized frameworks to evaluate the impact of extractive activities on the environment. Finally, the characteristics of the industry hinder a highly diversified supply chain. The companies depend principally on a few countries, among which China is the principal supplier of CMs, in particular of Rare Earth Elements, which are vital for renewable energy and electric vehicles. This results in one of the most important factors to consider for reducing the risk from CMs’ exposure. However, the lack of transparency, due to data scarcity concerning supply chain management and audits poses challenges to fully understanding the real potential of the model.

The future of CMs in sustainable investments

The future of CMs’ risk exposure in sustainable investment decisions is still uncertain yet promising. Incorporating this risk valuation represents an important step for alignment with the Paris Agreement goals and with the upcoming CSRD mandatory report regulatory framework, since the extraction of Critical Minerals generates important concerns for many industries’ Value Chains. However, questions arise regarding the effectiveness of the methodology, which will vary depending on the specific objectives set by the portfolio manager utilizing the model.

To address the challenges and achieve meaningful integration of CMs’ risk exposure, an important effort for the asset management sector is required. First of all, the asset manager has to identify the most important CMs for its portfolio, then simplify and adapt the model’s variables based on deeper proprietary information, and confront competitors’ results to outline mitigation strategies and engage effectively with the invested companies. Collaboration and knowledge-sharing with the International Energy Agency (IEA), other international organizations, and peers can accelerate the progress of methodology implementation. By integrating this model, the risk exposure can be reduced and the increased demand for sustainable investments can be tackled, leading to higher financial results and a higher volume of business, while positioning at the forefront of the Sustainable Investing Industry. Indeed, such integration would significantly help meet the sustainable investment goals, both in terms of financial and non-financial performance, and contribute towards the greater good of society.

Closing thoughts

The future of sustainability in the asset management sector remains of central importance. Investors are searching for sustainable portfolios and managers capable of reaching both their financial goals and values. The critical minerals industry, due to its importance for modern technologies and the green transition, is becoming one of the most important markets for Sustainable Development, so its challenges must be fully comprehended and tackled.

The comprehensive analysis provided by this innovative tool offers valuable insights for asset managers across a variety of industries. By utilizing this tool, managers gain a complete overview of their portfolios and can assess each company’s exposure to CMs. With this information, managers can make optimal decisions to build specific engagement strategies, address environmental issues by changing the portfolio’s structure, or maximize profits with price volatility insights. The model’s versatility allows for customization based on individual preferences and needs, with the ability to apply different weights to various factors. Additionally, the global applicability of the model enables managers to compare portfolio scores against benchmarks, providing crucial information on areas for engagement and contributing to a more responsible and sustainable financial system.

Therefore, by integrating this model into the portfolio analysis, the asset management sector can reduce exposure to CMs’ risk and align its practices towards sustainable goals for contributing to a more responsible and sustainable financial system.

About the Authors:

Michele Sacchi has worked in the finance team at By-Expressen, a bike messenger logistics and distribution collective company in Copenhagen. He is currently approaching the non-profit environment by participating in a volunteering project about microcredit in India.He is concluding his master’s degree in Applied Economics and Finance from Copenhagen Business School (CBS), where his research explored the impact of NGO activism on public European firms’ stock value, particularly highlighting the important role the NGOs should hold in reshaping the existing financial system. Michele also holds a minor in ESG and Impact Investments, during which he had the opportunity to develop this project with the team and Professor Kristjan Jespersen.

Bartolomeo Galli is a graduate of Innovation Management and Business Development at CBS. He has obtained a minor degree in ESG and Impact Investing. His research interest stays at the crossroads of the management of innovation in early-stage ventures and impact investing fields, to understand the tangible outcomes of impact techniques on ventures’ development. He is currently pursuing an internship at Antler, a leading early-stage venture capital firm. Concurrently, He is working at Novonesis, the leader in the Biosolutions industry, where he analyses the opportunities for commercial expansion of biosolutions for human health.

Prof. Kristjan Jespersen is an Associate Professor in Sustainable Innovation and Entrepreneurship at the Copenhagen Business School (CBS). Kristjan is an Associate Professor at the Copenhagen Business School (CBS). As a primary area of focus, he studies the growing development and management of Ecosystem Services in developing countries. Within the field, Kristjan focuses his attention on the institutional legitimacy of such initiatives and the overall compensation tools used to ensure compliance. He has a background in International Relations and Economics.

We would like to thank CWorldWide for developing and supporting the project led through CBS’s ESG Minor. The project led to the presented findings in this post.

- The core research was conducted by the CBS students Georgiana Pascu, Anne-Sophie Haas-Duverger, Michele Sacchi, and Bartolomeo Galli ↩︎