By Prof. Kristjan Jespersen, Walter Bachmann, and Tobias Warkotsch

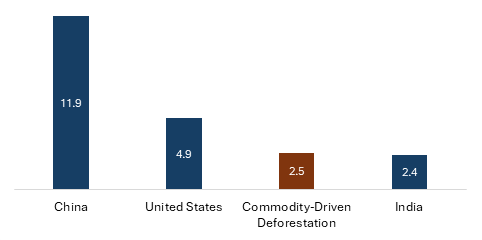

In an era marked by escalating climate extremes and accelerating biodiversity loss, the urgency to preserve the world’s forests has reached a critical moment. Recent data reveals a dip in deforestation around 2020 – likely due to the global slowdown caused by the COVID-19 pandemic – followed by a sharp resurgence, with deforestation rates surging by 2023. Commodity-driven deforestation is responsible for 18% of global forest loss and remains a major driver of ecological devastation. Its impact is even more pronounced in tropical regions, where it drives nearly 25% of forest loss. This destruction is primarily fueled by agricultural expansion, with commodities such as beef, soy, and palm oil being major contributors, particularly in Latin America and Southeast Asia. If treated as a country, commodity-driven deforestation would be the third-largest emitter of greenhouse gases worldwide, surpassed only by China and the United States.

Figure 1: Comparison of Greenhouse Gas Emissions in 2023 across countries and commodity-driven deforestation. Emissions are measured in billion metric tons of CO₂ equivalent (GtCO₂e).

This trend is not just alarming; it is edging us closer to an irreversible tipping point. Without immediate and collective action, the damage to our planet’s carbon stores, water cycles, and ecosystems will be permanent, with catastrophic consequences for future generations. Stakeholders, including consumers, corporations, financial institutions (FIs), and policymakers, must recognize this as the critical and final opportunity to demand and implement transparent, accountable, and sustainable forest management, as the time for action is not just urgent but our last chance to prevent irreversible harm and secure a sustainable future. Our research, conducted at the Copenhagen Business School and supported by Federated Hermes Limited, uses data from the Forest IQ dataset to cast light on how corporations and FIs across different regions tackle (or fail to tackle) deforestation risks.

This study leverages the Forest IQ database to analyze deforestation exposure and performance reporting across a diverse range of companies and FIs. Financial materiality for the value chain is excluded due to negligible significance and unreliable scores from limited dependencies. First, deforestation exposure assesses the extent to which firms or FIs are linked to high-risk commodity related activities, that are key drivers of deforestation. Finally, performance reporting evaluates the quality, transparency, and depth of entities’ commitments and actions reporting regarding deforestation and associated human rights issues.

It provides a comprehensive perspective by examining corporate value chains – including producers, traders, manufacturers, and retailers – as well as FIs such as banks and asset managers. Below, we delve into the core findings from our analysis, highlighting the surprising disparities among commodities and regions, as well as the emerging opportunities that might hold the key to future solutions.

Value Chain Findings

The role of commodities in driving deforestation varies significantly across industries. In the following, the value chain findings focus on the three major drivers of commodity-driven deforestation captured by the Forest IQ dataset: cattle, palm oil, and soy. Like cattle, soy is predominantly produced in Latin America, whereas palm oil production is concentrated in Southeast Asia.

Cattle remains the largest contributor to tropical deforestation, yet surprisingly, it exhibits low reported deforestation exposure. This discrepancy is likely due to underreporting and the prevalence of deceptive practices. Performance reporting scores are low, with limited public pressure and deforestation reporting largely absent. However, performance reporting tends to improve further down the value chain, despite the concentration of manufacturer headquarters in Asia, the worst performing region.

In contrast, palm oil demonstrates the strongest performance reporting among commodities. Public scrutiny and certification schemes, such as the Roundtable on Sustainable Palm Oil (RSPO), have played a significant role in fostering transparency and accountability. Palm oil also shows the smallest gap between deforestation commitments and actions reporting, indicating that many firms in the sector have begun aligning their policies with measurable outcomes. Despite a high concentration of manufacturers in regions with weaker sustainability practices, such as Asia, these firms often outperform retailers due to the pressure to achieve certifications and meet consumer expectations for sustainable products.

Soy’s performance reporting falls between cattle and palm oil, reflecting its position in the middle in terms of both sustainability initiatives and simpler supply chain dynamics.

The analysis of sustainability commitments and reporting practices reveals nuanced trends that are hidden within the underlying datapoints. No deforestation commitments are more common than no conversion commitments, yet the latter demonstrate stronger adherence to additional criteria, such as cut-off dates and comprehensive coverage of operations. No conversion ensures no natural ecosystems are cleared, unlike no deforestation, which focuses only on forests. However, a troubling trend is the significant decline in commitments to protect activists at higher levels of the value chain, suggesting an increased tolerance for or use of intimidation tactics against scrutiny. Reporting often emphasizes positively framed metrics, such as areas free from deforestation, while omitting data on negatively framed outcomes, such as land already deforested.

Financial Institutions Findings

FIs hold substantial leverage in addressing deforestation but demonstrate considerable variation in commitments and actions reporting. Deforestation exposure is highly concentrated, with the top 10 FIs accounting for nearly one-third of total financial exposure. North America has the highest deforestation exposure, with few FIs bearing substantial financial risk.

Performance reporting highlights significant trends. Palm oil consistently outperforms other commodities, followed by soy. However, performance distribution remains highly skewed, with the majority of FIs failing to meet minimal standards. Deforestation commitments reveal critical gaps. Cut-off dates for holdings are rarely implemented, and policy coverage often excludes key operational areas across FI portfolios. Human rights commitments emphasize labor rights but show limited progress on gender equality. While Free, Prior, and Informed Consent (FPIC) rights receive attention, indigenous rights and activist protection remain largely excluded. Actions reporting demonstrates a preference for superficial compliance measures, such as identifying non-compliance and implementing grievance mechanisms, rather than resource-intensive solutions. Active engagement with holdings is notably limited.

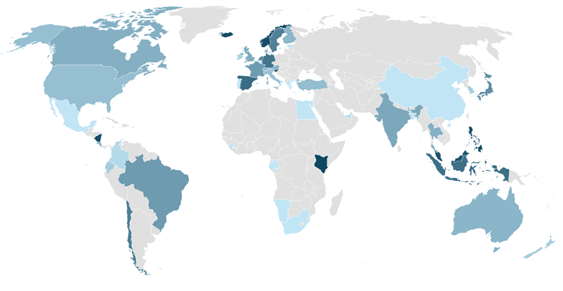

Regionally, the European Union (EU) leads in overall performance reporting, with Asia following. European non-EU countries, Latin America, and the Middle East show average performance. North America performs the worst despite its high financial exposure, while Africa and Oceania lag. Oceania, however, excels in human rights commitments.

Figure 2: FIs performance reporting scores per country. Darker blue indicates a better score, while lighter blue represents lower scores.

Comparative Analysis: Value Chain & Financial Institutions

The comparison between FIs and firms in the value chain highlights both similarities and differences in performance reporting. While firms in the value chain perform better than FIs, they still fall short of achieving sufficiently robust and reliable performance reporting. A key similarity is that palm oil consistently leads, with soy trailing behind. Across both FIs and firms, human rights commitments tend to outperform deforestation commitments, a trend that extends to actions reporting for the value chain as well. Notably, the EU, as a headquarters region, stands out as the best-performing region for both FIs and retailers, which is likely due to stricter regulations such as the Corporate Sustainability Reporting Directive (CSRD) and the EU Deforestation Regulation (EUDR).

However, important differences exist between the two groups. FIs tend to show stronger actions reporting than commitments, driven by their indirect involvement. Additionally, increasing regulatory pressure compels FIs to provide comprehensive deforestation reporting. On the other hand, firms within the value chain show stronger commitments compared to actions reporting, largely because of their direct control over impacts. Public scrutiny often prioritizes commitments, but implementing tangible actions remains a significant challenge. Furthermore, Asia emerges as the weakest region for the value chain, attributed to low regulatory enforcement and the prioritization of food security concerns. These findings underscore the varying dynamics shaping performance reporting across FIs and the value chain.

Opportunities in Fighting Deforestation

Agroforestry has seen only a few trial runs across commodities, making its use relatively uncommon despite its potential. Certification schemes are more widely adopted but face clear challenges, particularly with enforcement and credibility. However, there is a positive outlook on leveraging satellite imagery, artificial intelligence, and on-the-ground investigation technologies to monitor and combat deforestation effectively. FIs also hold significant influence, as they can exert pressure on companies to implement deforestation-free policies, driving meaningful change in supply chains.

Conclusion

In conclusion, preserving the world’s forests in the face of commodity-driven deforestation is a critical challenge with far-reaching ecological, social, and economic implications. This study sheds light on how value chains and FIs are navigating deforestation risks and responsibilities. While some progress is evident, particularly in the palm oil sector, significant gaps remain in both commitments and actionable measures across commodities and regions.

The findings highlight the need for robust and enforceable deforestation-free policies, supported by advanced monitoring technologies like satellite imagery and artificial intelligence. FIs hold unique leverage to push for systemic change by aligning capital flows with sustainability goals, while firms within value chains must focus on translating commitments into impactful actions.

Collaboration among governments, corporations, and FIs is crucial to improve practices, enhance transparency, and adopt innovative solutions, ensuring forest protection and sustainable futures for dependent communities.

About the Authors:

Prof. Kristjan Jespersen is an Associate Professor in Sustainable Innovation and Entrepreneurship at the Copenhagen Business School (CBS). Kristjan is an Associate Professor at the Copenhagen Business School (CBS). As a primary area of focus, he studies the growing development and management of Ecosystem Services in developing countries. Within the field, Kristjan focuses his attention on the institutional legitimacy of such initiatives and the overall compensation tools used to ensure compliance. He has a background in International Relations and Economics.

Walter Bachmann is an ESG Research Assistant at Nordic ESG Lab and a master’s student in Finance and Investments at Copenhagen Business School. He holds a bachelor’s degree in International Business Administration from Tallinn University of Technology, graduating with First Class Honors. Before joining Nordic ESG Lab, Walter worked as an M&A Analyst at LNP Corporate Finance, where he actively participated in deals from start to finish. He is proficient in developing complex financial and valuation models, as well as creating investor and client presentation materials. This year, Walter is focusing on sustainability by pursuing a minor in ESG at Copenhagen Business School. He is also actively involved in Oikos Copenhagen, a student-led initiative promoting collaboration for a sustainable future.

Tobias Warkotsch is an ESG Research Assistant at Copenhagen Business School’s “Making Oceans Count” project and a master’s student in Finance and Investments, pursuing a minor in ESG. He holds a bachelor’s degree in Business Administration and Economics from the University of Passau, Germany. Before joining the “Making Oceans Count” project, Tobias gained experience as a consultant intern at Roland Berger and KPMG, where he contributed to M&A, restructuring, and ESG projects, showcasing his expertise in financial modeling, due diligence, and supplier analysis. He also worked at BMW, where he focused on sustainability, including CO2 emissions quantification and the development of circular economy strategies.