By Prof. Kristjan Jespersen, Jakob Moltesen Kristensen, Aske Bonde, Kristian Stub Precht and Rasmus Nautrup Houmøller

As global environmental pressures intensify, the focus on sustainable investments has never been more critical. However, one domain often overlooked in ESG frameworks is the blue economy. While the ocean plays a crucial role in global sustainability the maritime sector faces persistent challenges in data transparency and standardization, limiting its potential for impactful investments. This blog explores insights from a recent study on integrating asset-level data to assess environmental impacts in two key ocean industries: offshore wind and shipping. The findings highlight innovative methodologies and frameworks that could redefine the way in which ESG data is used in the blue economy.

The challenge

Investing in marine industries poses a unique challenge. Shipping and offshore wind is characterized by high complexity in assessing impacts due the complicated nature of the ocean. Here, certain mitigation strategies for one type of impact can be the cause of harm in other areas. It is therefore critical that companies and investors have a foundation from which they can weigh different impacts to minimize the overall harm to the ocean. However, data limitations and a lack of a centralized reporting structure amplify these issues and result in fragmented insights and hindered decision-making for investors. This creates barriers to identifying and scaling sustainability-focused investments. Yet, it also presents opportunities to develop innovative models for environmental impact assessments using highly granular data.

Building an Ocean Impact Framework

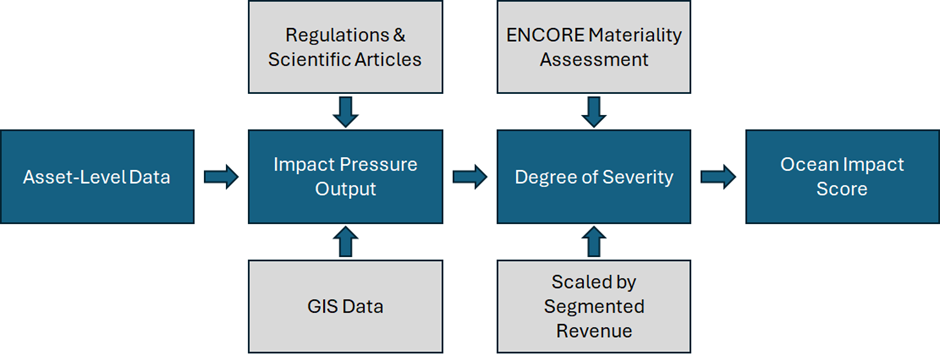

The proposed investment framework addresses these challenges by leveraging granular asset-level data to assess and weigh different types of impact. Such metrics are specific to individual assets within a company’s portfolio and allow for increased measurability. Key features of the framework include:

- Data categorization: Ownership, location, and technical specifications of assets are integrated to provide a granular understanding of environmental pressures and to correctly assign responsibility.

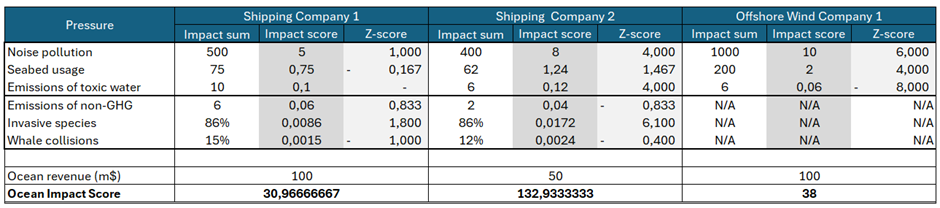

- Pressure methodologies: Impact factors such as underwater radiated noise, non-GHG emissions, and whale collisions are modeled to quantify and measure harm.

- Ocean Impact Score: The outputs are consolidated through the use of Z-scores to compare cross-sectoral impacts, enabling investors to measure improvements and identify best-in-class performers which encourages industry-wide progress.

Illustration 1: Roadmap to an Ocean Impact Score.

This framework not only facilitates comparisons between offshore wind and shipping but also aligns with global regulatory standards such as the EU Taxonomy and voluntary initiatives like ENCORE and the TNFD.

A crucial aspect of this framework is its adaptability to existing data limitations. By introducing scaling factors such as segmented revenue, the model accounts for the societal benefits of maritime industries, rewarding companies that reduce their environmental footprint while maintaining output.

Additionally, the incorporation of Geographic Information System data enhances the framework’s ability to measure impacts in sensitive marine areas, such as Marine Protected Areas. This approach ensures that the most vulnerable regions receive priority attention.

Illustration 2: Ocean Impact Score Model. Constructed for illustrative purposes.

Policy and industry recommendations

For meaningful change, collaboration between regulators, industry stakeholders, and investors is essential. Key recommendations include:

- Centralized data hubs: Establishing shared platforms for asset-level data can enhance transparency and accessibility.

- Collaborative effort: A collaborative effort between stakeholders is essential to develop the necessary tools to establish reliable reporting methodologies within the sector

- Enhanced regulation: Introducing thresholds for environmental impacts can drive compliance and innovation.

A call to action for investors

Investors hold a significant responsibility in driving the sustainability transition of the blue economy. By adopting the proposed framework, they can make more informed decisions, prioritize high-impact areas, and actively engage with companies to promote sustainability practices. Investors should focus on rewarding companies for transparent reporting despite potentially high impacts and engage with companies on measurable change parameters. Ultimately, the transition to a more sustainable blue economy requires not only innovative methodologies but also a collective commitment to leveraging data for impact. As the framework evolves, it has the potential to transform ESG investment strategies and pave the way for a more sustainable and healthy ocean.

About the Authors:

Prof. Kristjan Jespersen is an Associate Professor in Sustainable Innovation and Entrepreneurship at the Copenhagen Business School (CBS). Kristjan is an Associate Professor at the Copenhagen Business School (CBS). As a primary area of focus, he studies the growing development and management of Ecosystem Services in developing countries. Within the field, Kristjan focuses his attention on the institutional legitimacy of such initiatives and the overall compensation tools used to ensure compliance. He has a background in International Relations and Economics.

Jakob Moltesen Kristensen is an MSc Finance and Strategic Management student at Copenhagen Business School, with professional experience in financial analysis and organizational transformation. Jakob has previously conducted a research project on polyethylene in consumer products and is passionate about ESG-focused initiatives and has completed a minor in ESG Metrics and Sustainable Investments.

Aske Bonde is a Business Analyst at a Nordic consulting company and an MSc Finance and Strategic Management student at Copenhagen Business School, where he also completed a Minor in ESG Metrics and Sustainable Investments. Aske is passionate about creating innovative solutions at the intersection of sustainability, business, and technology.

Kristian Stub Precht is a graduate student at Copenhagen Business School majoring in Finance and Strategic Management with a minor in ESG Metrics and Sustainable Investments. His academic interests lie in sustainable corporate investments, particularly from an asset management and business expansion perspective. He is currently employed as an M&A Consultant at a medium-sized third-party logistics provider. In his spare time, Kristian unwinds through activities like golf, hiking or video games.

Rasmus Nautrup Houmøller is a graduate student pursuing a Master’s in Finance and Strategic Management at Copenhagen Business School, with a minor in ESG Metrics and Sustainable Investments. Currently, he is a Junior Analyst at a Nordic-based investment manager with upcoming employment as a Financial Consultant. His academic interests and passion lie at the intersection of ESG, portfolio- and risk management. Outside his studies, he finds enjoyment in physical activities, cooking, and reading different kinds of literature.